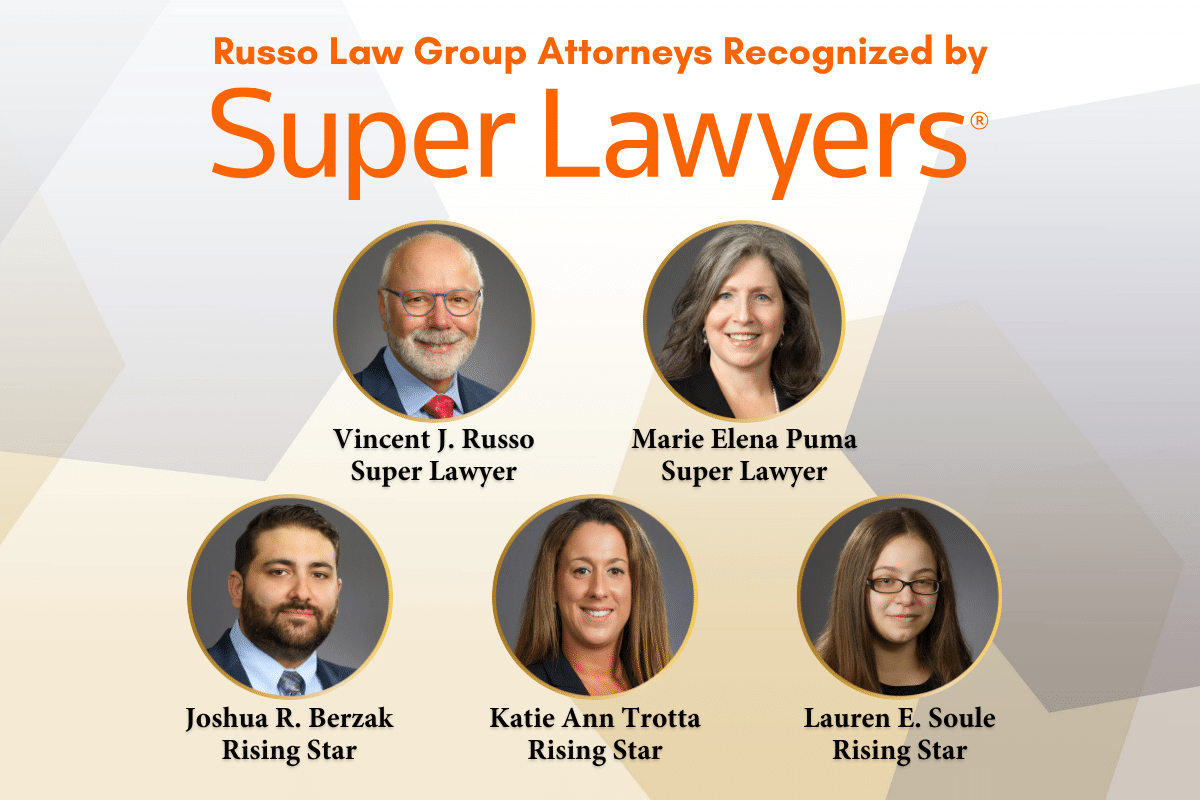

We are proud to announce that Russo Law Group has once again been recognized in…

“So what,” you say?

Let’s say Joan is applying for Medicaid benefits and she has a retirement account of $100,000. On its face, it would appear that she is not eligible for Medicaid because she is over the asset limit for Medicaid purposes (which, for 2016, is $14,850).

However, Medicaid will allow Joan to keep her IRA as long as she “maximizes” her distribution from her IRA. For Medicaid purposes, the maximum distribution is the amount taken as determined by the life expectancy table issued by the Social Security Administration (SSA). The distribution amount is then counted as income to Joan and the IRA principal is not counted as a resource against the $14,850 allowance.

The SSA updated the table for 2015, prompting the issuance of the GIS on April 25, 2016, effective immediately.

It is very important to withdraw the correct amount from a retirement account so that Medicaid benefits can be appropriately accessed. Our firm can assist with the Medicaid application process and advise our clients as to the proper amount to be withdrawn from a retirement account.

Contact us with questions or comments.

Russo Law Group, P.C.

100 Quentin Roosevelt Blvd., Suite 102

Garden City, NY 11530

800-680-1717

Comments (0)