Multigenerational estate and retirement planning is more than a personal task—it’s a family commitment. By…

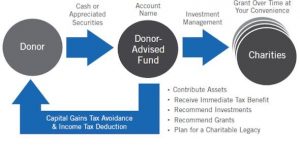

When helping our clients plan for retirement, many express their interest to set aside money for charity. Some clients have a specific charity in mind, while others simply want to set aside an amount to be given to a charity at a later date. A donor-advised fund, or DAF, is a perfect vehicle for charitable giving, while also offering tax benefits to boot.

A DAF is a fund or account that is established, maintained and operated by a public charity (as defined under Section 501(c)(3) of the Internal Revenue Code). Each DAF is comprised of donations made by

Are there requirements I should know about?

As a starting point, the donor generally needs at least $5,000 to open an account, however once established, a donor can make charitable grants of as little as $50. Unlike other charitable vehicles which have mandatory annual distributions (e.g. private foundations require an annual five percent distribution), the DAF does not have a mandatory distribution schedule. Because the donation to the DAF is treated as a gift to a 501(c)(3) public charity, donations of cash are limited to an income tax deduction of up to 50% of the donor’s adjusted gross income (AGI) and donations of long term capital gain property are capped at 30% of the donor’s AGI.

But how does this differ from simply donating to a charity?

A DAF is like a charitable savings account or piggy bank. A DAF allows the donor to donate assets and receive a tax deduction today, and delay granting the funds to a charity until a later day. In the meantime, the assets inside the fund continue to grow tax-free. Additionally, unlike some charities which may not be able to accept non-cash donations, a donor can contribute appreciated assets to a DAF. This is a terrific opportunity because it allows a donor to avoid paying capital gains that would otherwise be triggered if the donor sold the appreciated property in order to contribute cash to charity, and take a deduction at the property’s higher fair market value.

Contact an experienced estate planning attorney if you are considering donating to charity. By doing so, you can ensure you are choosing the charitable giving vehicle best suited for your situation.

Russo Law Group, P.C.

100 Quentin Roosevelt Blvd., Suite 102

Garden City, NY 11530

800-680-1717

Comments (0)