This originally aired on the Catholic Faith Network’s show CFN Live: https://youtu.be/aQgwbQkJtC0 How can SSI…

How can a Supplemental Needs Trust Protect Assets for a Child with Special Needs

This originally aired on the Catholic Faith Network’s show CFN Live: https://youtu.be/lKcsEZXENoI

What should parents of a child with special needs be thinking about when it comes to their estate plan?

The number one concern of all parents is making sure that their children are taken care of. This is of heightened concern when parents have a child with special needs. No parent wants to consider what will happen if they are not around to take care of that child with special needs.

From my personal experience with my daughter, Theresa, and meeting with hundreds of families over the years, there are steps that can be taken to help protect your children, notably the use of a Supplemental Needs Trust.

What is a Supplemental Needs Trust?

A Supplemental Needs Trust is a Trust that the parents can set up for the benefit of their child with special needs. The parents can be the initial trustees of the Trust. The parents would fund the trust while alive by making gifts or upon their demise by leaving assets under their Last Will and Testament.

This trust is different that a First Party Special Needs Trust because there is no requirement to pay back Medicaid from the Trust assets when the child passes away.

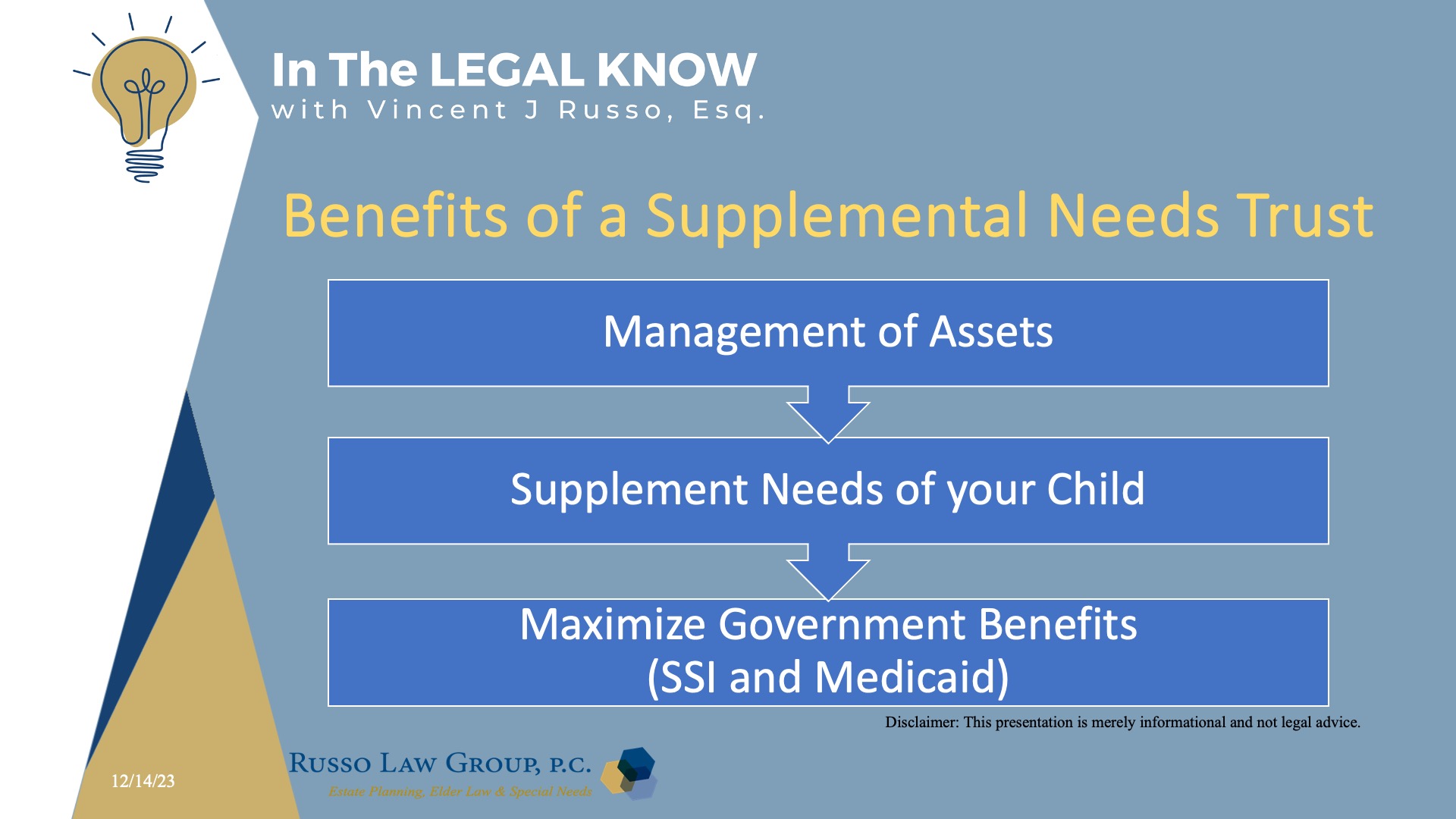

What are the benefits of a Supplemental Needs Trust?

The primary benefit is that assets are set aside in the trust to be used for the benefit of the child with special needs during his or her lifetime. So, the trustee can take care of living expenses, and spend funds to enhance the child’s quality of life.

Meanwhile, the child can qualify for government benefits such as Supplemental Security Income (SSI) and Medicaid. The assets in the trust will not be counted against the child filing for those benefits.

Should parents set the Trust up while alive or under their Will when they pass?

Should parents set the Trust up while alive or under their Will when they pass?

This will depend on the individual family situation. The benefit of setting it up while you are alive is that you have the comfort that the trust is in place. It can be funded with a nominal amount or more during the parent’s lifetime and it can be revocable.

This approach will also allow other family members such as grandparents to contribute assets to the trust for the benefit of their child.

The downside is that there will be fees attached to setting up the trust while you are alive.

The other important question I receive from parents is how much they should leave to the Trust versus leaving assets to other children. This is where a planning meeting is essential in discussing the options. There are no fixed rules on how much to leave in trust.

Wouldn’t it be cheaper and easier to leave the assets to a sibling of that special needs child?

I put that strategy in the category of RISKY. First, there is an assumption that the sibling is available and capable to take care of their sibling and to manage the assets and maximize government benefits for the sibling.

The Trust allows the parents to have their assets held in a protective way for their child. What happens in the simple strategy posed if the sibling has creditor problems, becomes disabled or passes away? There are too many situations that could arise which could jeopardize the well-being of their child with special needs.

CLICK HERE to download our Complimentary Special Needs Planning Guide.

We hope you found this article helpful. Contact our office today at 1 (800) 680-1717 and schedule an appointment to discuss what makes sense for you and your loved ones.

This Post Has 0 Comments