Realizing that you or a loved one needs to move into a nursing home can…

A family member introduced him to me– and now, I cannot imagine doing any other type of law.

I love meeting with families and helping them when they are in difficult situations. It is incredibly rewarding to be able to help someone through a crisis, and come up with solutions that enable them to preserve their dignity and protect their assets.

Case Study #1: Years ago a woman came in to talk about her mother (in a nursing home) who needed to apply for Medicaid. Her mother had approximately $30,000 in the bank.

When I asked how long her mother had been in the nursing home, she answered, “About two and a half years.”

Back then, the cost of residing in such a home was about $10,000 per month. If her mother had been in the nursing home for two and a half years, and had never been on Medicaid, it was easy to know that she had been paying privately all that time.

So I asked, “How did you decide to come to us? And why now?”

She explained that the nursing home had referred her, because her mom was almost out of money.

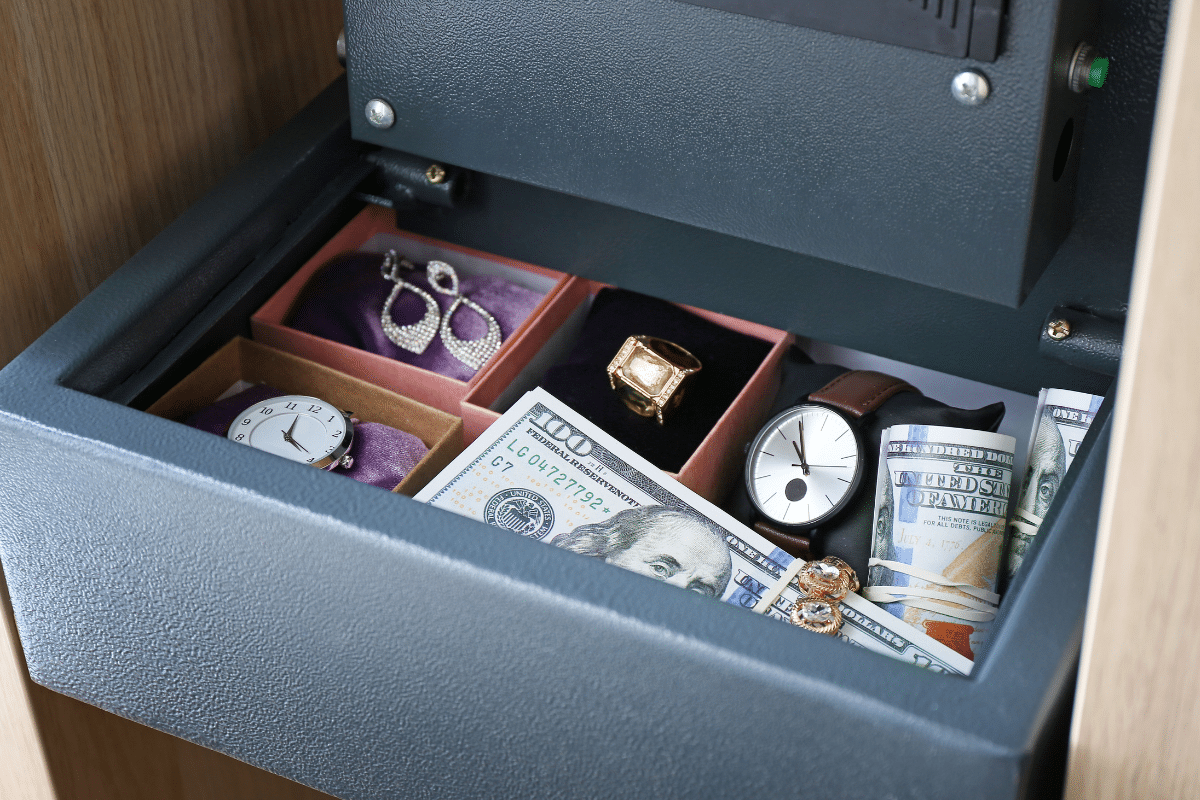

It was frustrating. The person at the nursing home could have, and I think should have, referred her earlier, when her mother had nearly $350,000 in the bank. A plan could have been implemented to protect some of that money for the family.

There is a lesson to be learned here: Do not let this happen to you – it is almost never too late to plan.

Case Study #2: I met with the son of my client. She (the client) had come in to do some basic estate planning several years earlier. Her son came in as a follow up because he was now in a similar situation as the woman in our first scenario. However, his mother had only recently entered a nursing home. She had about $120,000 in the bank, in a joint account with him.

He thought it was too late to plan and that the money would be lost. But, I explained to him that there were still things we could do. We went over a plan and I showed how I could save him about $60,000. He was thrilled.

When he stood up to leave, I noticed he had a cane. I asked him about it and he said he had a “bad” hip. I asked if he was disabled and he said, “Yes.”

I told him to sit back down and explained that we would be coming up with a new plan; because there is an “exception” in Medicaid which states that you can give all of your money to a “disabled child”– it is 100% protected.

The lesson here – seek the services of an experienced elder law attorney who knows the rules and just as importantly the exceptions to the rules.

You may call for an appointment with one of our experienced team of elder law attorneys at: Russo Law Group, P.C.

If it becomes necessary for one of your parents to enter a nursing home, how would you protect their life savings?

Comments (0)