This originally aired on the Catholic Faith Network’s show CFN Live: https://youtu.be/_37V4R4aXYo Today, many people…

This originally aired on the Catholic Faith Network’s show CFN Live: https://youtu.be/G8BetpSDW3o

No one likes surprises when it comes to medical bills.

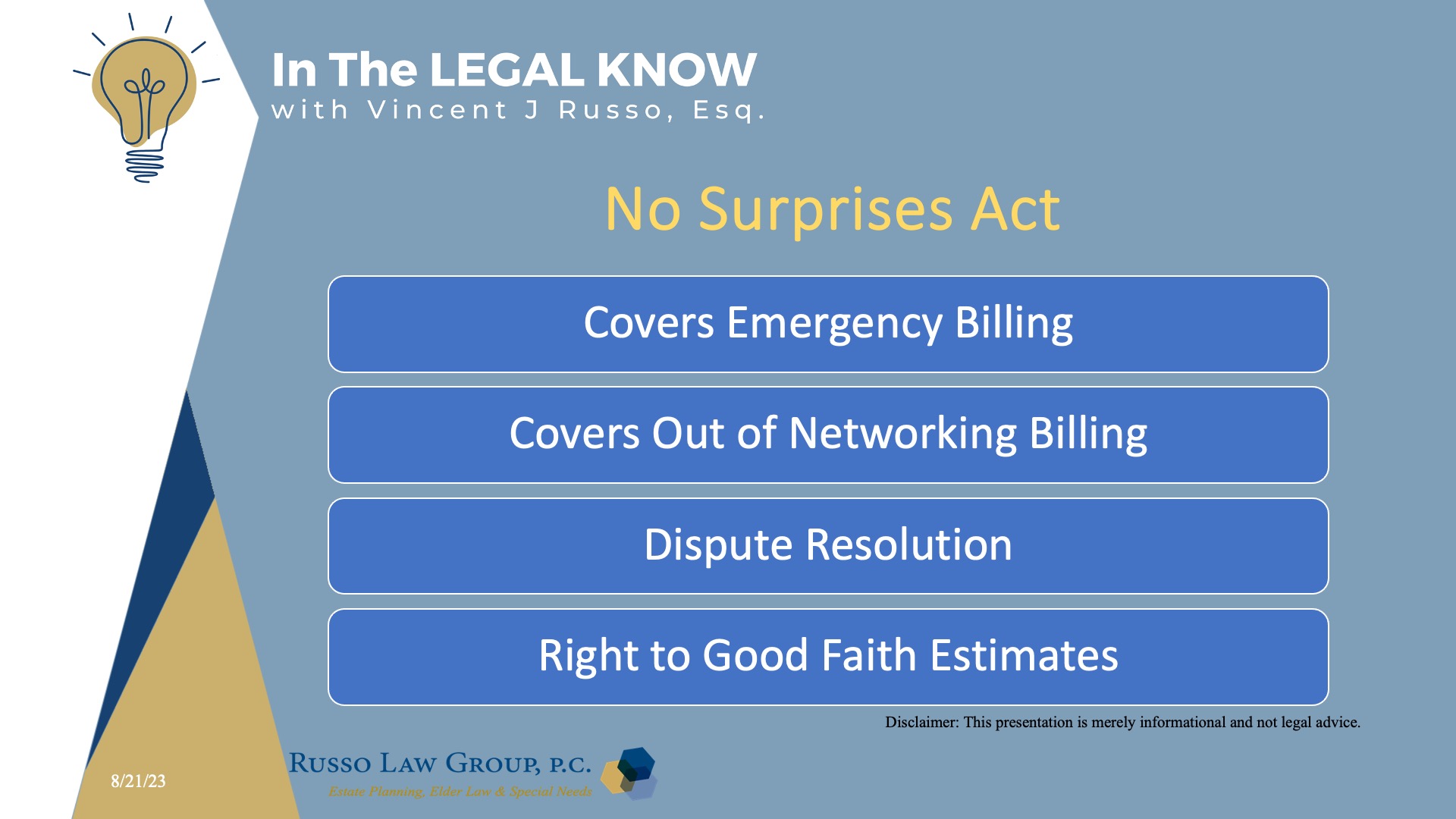

The No Surprises Act protects people covered under group and individual health plans from receiving surprise medical bills when they receive most emergency services, non-emergency services from out-of-network providers at in-network facilities, and services from out-of-network air ambulance service providers.

It also establishes an independent dispute resolution process for payment disputes between plans and providers and provides new dispute resolution opportunities for uninsured and self-pay individuals when they receive a medical bill that is substantially greater than the good faith estimate they get from the provider.

From 2022, these new protections prevent surprise medical bills. If you have private health insurance, these new protections ban the most common types of surprise bills.

If you’re uninsured or you decide not to use your health insurance for a service, under these protections, you can often get a good faith estimate of the cost of your care up front, before your visit. If you disagree with your bill, you may be able to dispute the charges.

What are surprise medical bills?

Before the No Surprises Act, if you had health insurance and received care from an out-of-network provider or an out-of-network facility, even unknowingly, your health plan may not have covered the entire out-of-network cost. This could have left you with higher costs than if you got care from an in-network provider or facility.

In addition to any out-of-network cost sharing you might have owed, the out-of-network provider or facility could bill you for the difference between the billed charge and the amount your health plan paid, unless banned by state law. This is called “balance billing.” An unexpected balance bill from an out-of-network provider is also called a surprise medical bill.

People with Medicare and Medicaid already enjoy these protections and are not at risk of surprise billing.

What are the new protections if I have health insurance?

If you receive health coverage through your employer, a Health Insurance Marketplace®, or an individual health insurance plan you purchase directly from an insurance company, these new rules will:

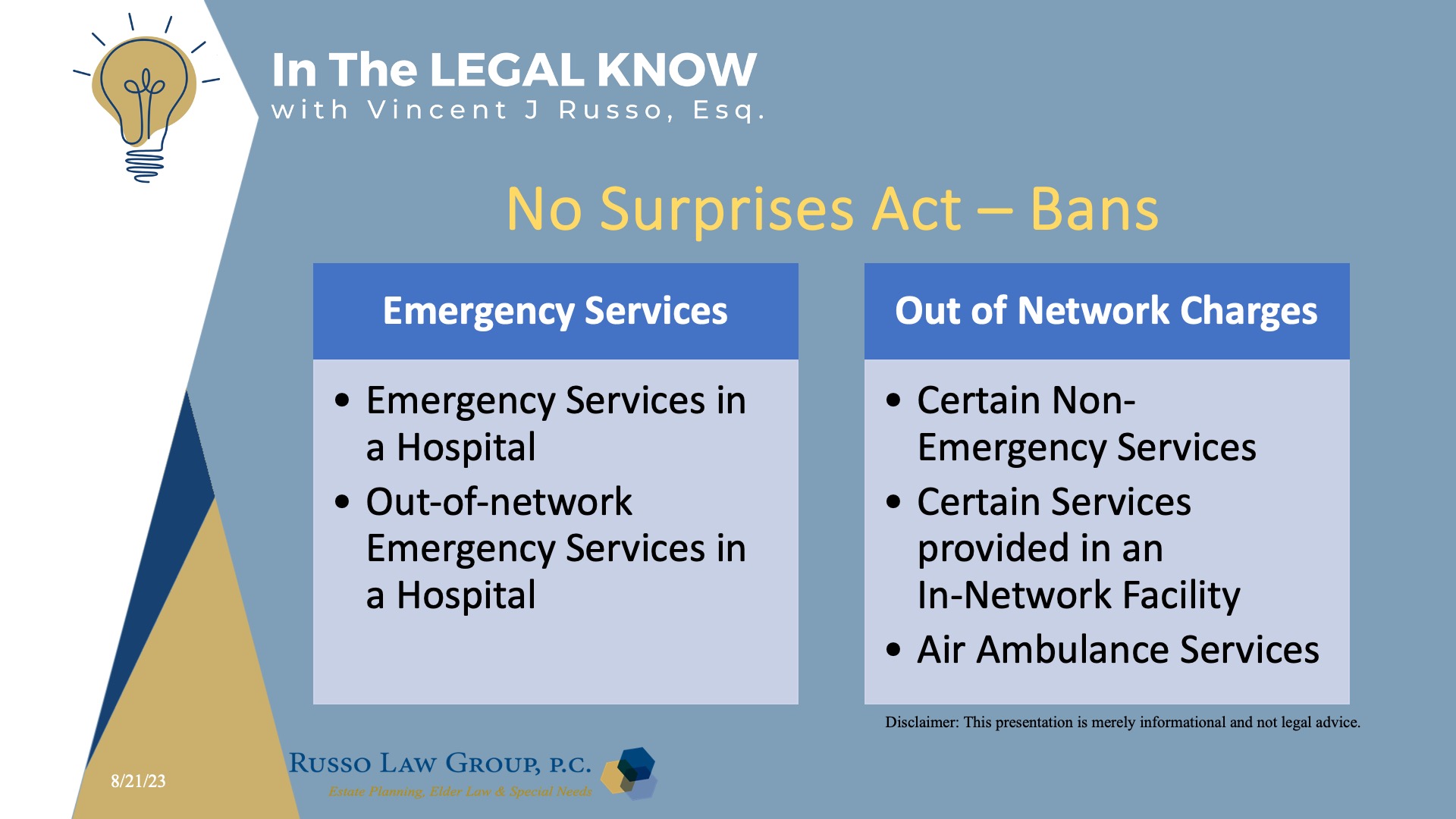

- Ban surprise bills for most emergency services, even if you get them out-of-network and without approval beforehand (prior authorization).

- Ban out-of-network cost-sharing (like out-of-network coinsurance or copayments) for most emergency and some non-emergency services. You can’t be charged more than in-network cost-sharing for these services.

- Ban out-of-network charges and balance bills for certain additional services (like anesthesiology or radiology) furnished by out-of-network providers as part of a patient’s visit to an in-network facility.

- Ban out-of-network charges for air ambulance services (only responsible for charges for co-pays, coinsurance, and deductibles).

- Require that health care providers and facilities give you an easy-to-understand notice explaining the applicable billing protections, who to contact if you have concerns that a provider or facility has violated the protections, and that patient consent is required to waive billing protections (i.e., you must receive notice of and consent to being balance billed by an out-of-network provider).

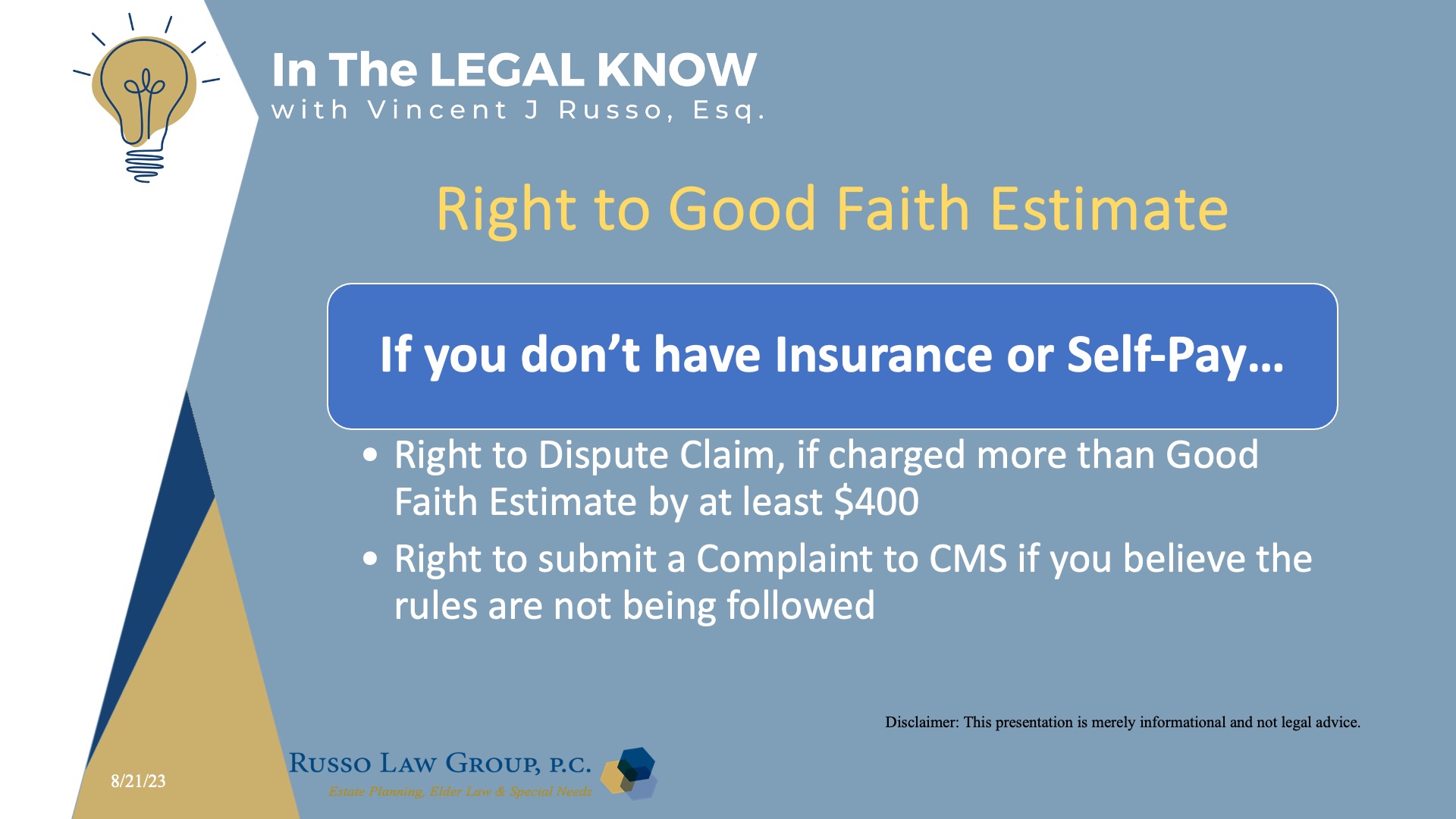

What if I don’t have health insurance or choose to pay for care on my own?

If you don’t have insurance or you self-pay for care, in most cases, these new rules make sure you can get a good faith estimate of how much your care will cost before you receive it.

If you are charged more than the good faith estimate for services provided, you can dispute a medical bill if your final charges are at least $400 higher than your good faith estimate and you file your dispute claim within 120 days of the date on your bill. You can submit a complaint if you believe that your facility, provider or insurer is not following the rules.

What if my state has a surprise billing law?

The No Surprises Act supplements state surprise billing laws; it does not supplant them. There are approximately 33 states that have enacted laws against surprise medical billing. At least 18 states had comprehensive protections, while 15 states had law partially protecting consumers against surprise medical bills.

The No Surprises Act instead creates a “floor” for consumer protections against surprise bills from out-of-network providers and related higher cost-sharing responsibility for patients.

So as a general matter, as long as a state’s surprise billing law provides at least the same level of consumer protections against surprise bills and higher cost-sharing as does the No Surprises Act and its implementing regulations, the state law generally will apply.

We hope you found this article helpful. Contact our office today at 1 (800) 680-1717 and schedule an appointment to discuss what makes sense for you and your loved ones.

Comments (0)