This originally aired on the Catholic Faith Network’s show CFN Live: https://youtu.be/aQgwbQkJtC0 How can SSI…

Medicaid and Spousal Protections

This originally aired on the Catholic Faith Network’s show CFN Live: https://youtu.be/ndDdA6xovQc

How can seniors afford care?

This has been the critical question seniors have been asking for decades. We have a broken long term care system and Medicaid is the only government program that covers long term care (assistance with activities of daily living). For married couples, the good news is that there are spousal protections in the Medicaid laws.

What are these protections?

We first must look at how one qualifies for Medicaid to pay for long term care at home, in an assisted living residence or in a nursing home. There are strict eligibility requirements but many exceptions to the rules.

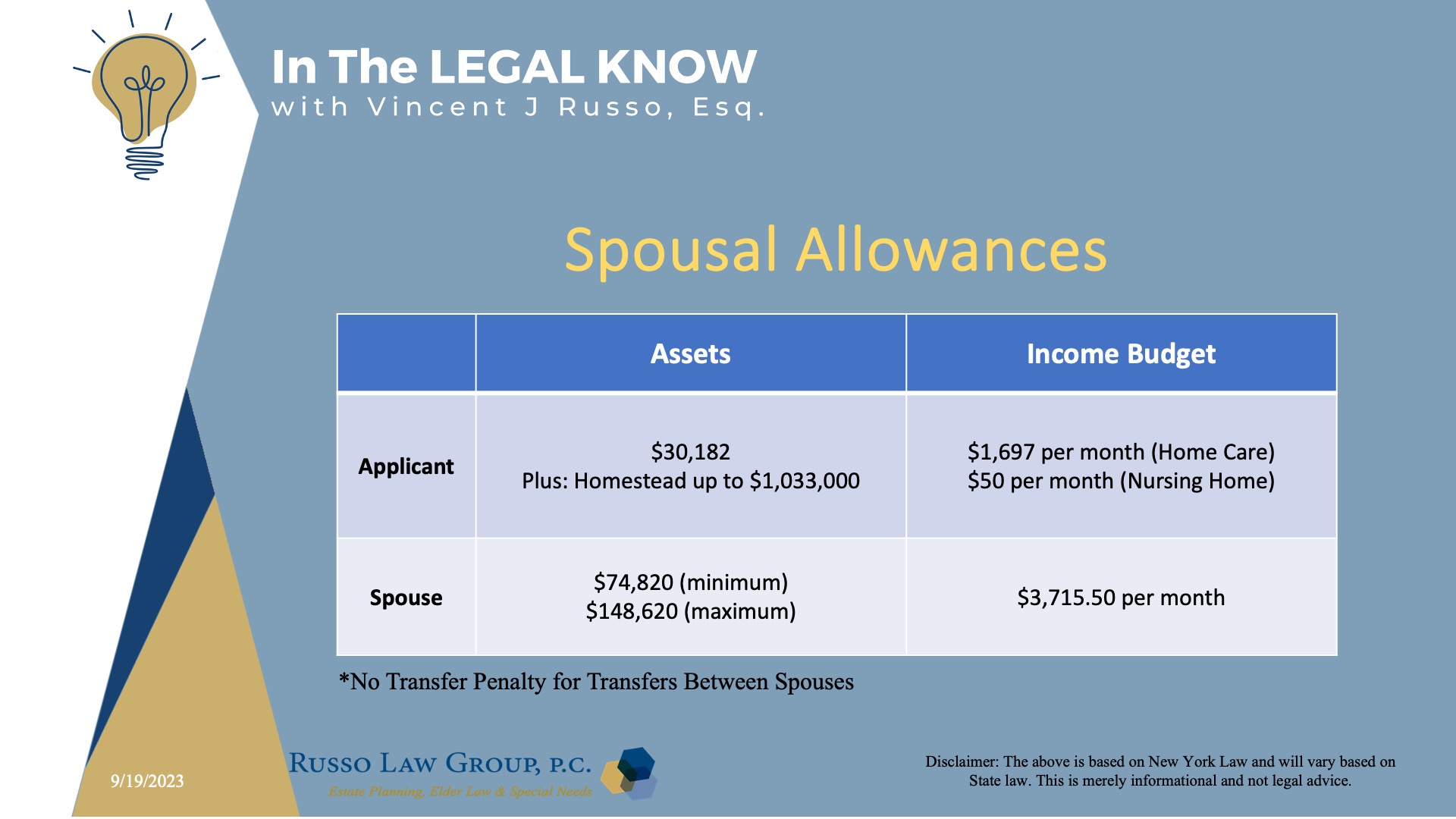

Basically, it breaks down to an asset test and an income budget for spend-down. For a married couple in New York, when one applies for Medicaid, the applicant spouse can have assets of up to $30,182.

But there are protections for a married couple (sometimes referred to as “Spousal Impoverishment” or Spousal Allowances which can vary State by State). For example, in New York, the non-applying spouse can have assets of up to $148,620 plus a home worth up to $1,033,000.

How does it work if one spouse needs home care services?

To qualify for Medicaid, the applying spouse must have less than $30,182 in assets. If there are additional assets, they would need to be transferred to the non-applying spouse. The transfer is an exempt transfer under the Medicaid rules. So, there is no penalty for transferring assets between spouses.

The spouse would then apply for Medicaid once the applicant spouse is under the resource allowance of $30,182. Medicaid will then review the assets of non-applying spouse and if the assets are below the Spousal Allowance (from $74,820 up to $148,620), then Medicaid will be approved.

Now, there is another step. Once approved, there is an income budget rule. The applicant spouse is allowed to keep $1,697 of their monthly income and the well spouse is allowed to keep $3,715.50 of their monthly income. The total income would be $5,412.50.

Any assets and income above those levels would have to be spent down to receive Medicaid benefits for the applicant spouse.

Are the rules the same of care in an assisted living facility or in a nursing home?

In New York, the rules we just discussed are the same for a resident in an assisted living facility that has Medicaid beds available under the Medicaid Assisted Living Program (the “ALP” program). If not, then only the care services can be covered under the Medicaid program and not the cost of room and board.

For Nursing home care, similar rule except the applicant spouse is only allowed to keep $50 per month.

Can any steps be taken to protect the assets and income which are above the Spousal Allowance amount?

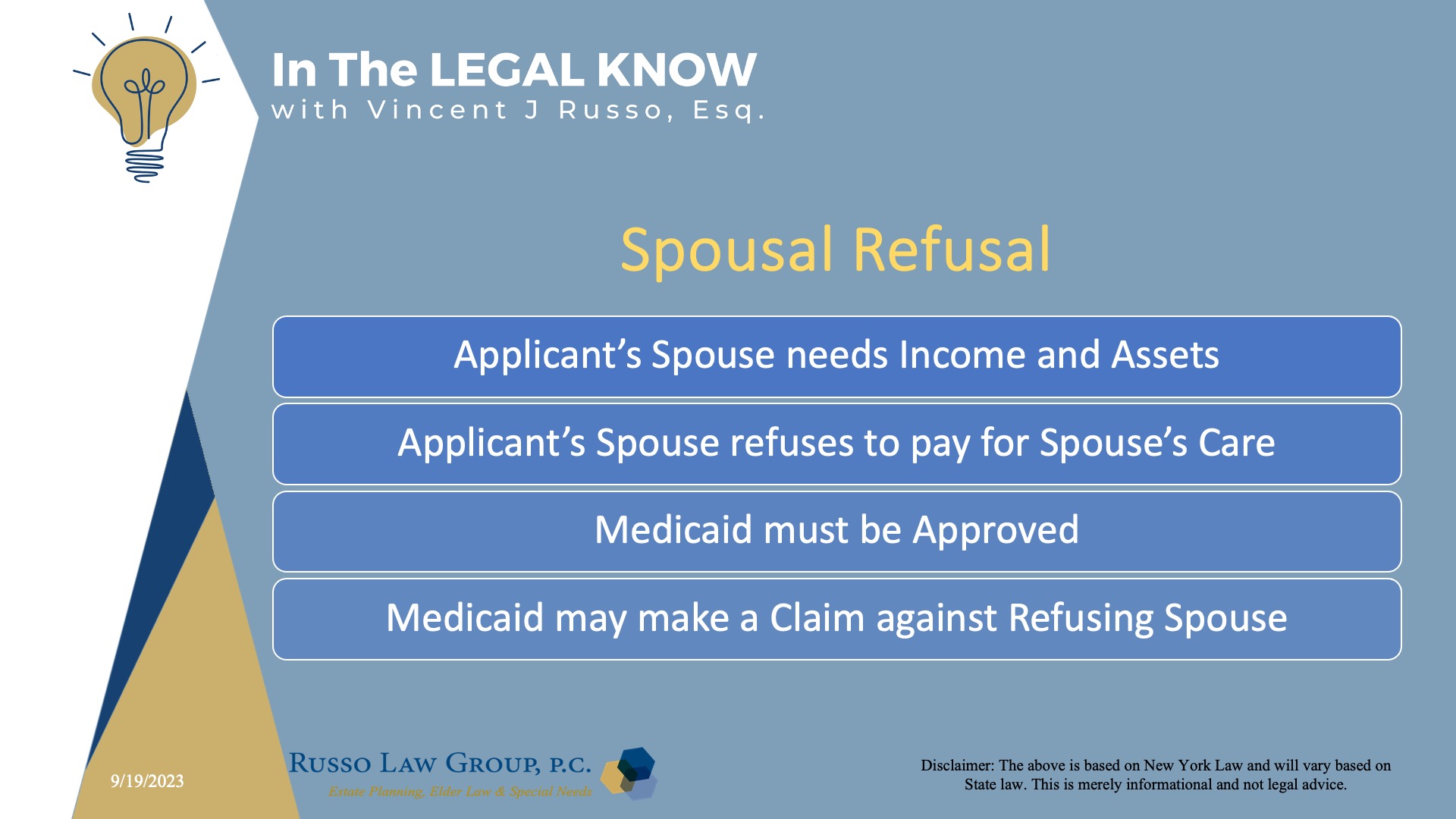

The answer is “yes” in New York and “maybe” in other states. This brings us to the doctrine of Spousal Refusal.

The resources and income of a community spouse in excess of the spousal allowances will be deemed available to the Medicaid applicant spouse and Medicaid will be denied.

The law allows a community spouse to refuse to contribute excess resources and/or income to the Medicaid applicant spouse. This is known as “spousal refusal” which is accepted in New York but not by all States. In such a case, the excess assets and income will not be counted against the applicant spouse for determining Medicaid eligibility.

Can Medicaid make a claim against a refusing spouse under these Medicaid rules?

In such an event, said resources and/or income shall not be deemed available to the Medicaid applicant spouse for purposes of Medicaid eligibility, but may still subject the refusing spouse to a lawsuit as referred to above. The Department of Social Services (“DSS”) in New York has taken the position that it has the right, on behalf of the spouse residing in a nursing facility, to sue the community spouse for support and may commence a legal action to seek the support.

Certain counties in New York do not make a claim. An experienced elder law attorney can advise you as to what the position is of Medicaid in your local county.

In summary…

No one should lose all of their assets because they need long term care. For married couples, there are spousal protections and no transfer penalty for transfers between spouses. Therefore, in most situations, with proper Medicaid planning, Medicaid can be obtained for the spouse needing care while protecting their assets.

The best advice I can give if one spouse needs care is to meet with an experienced elder law attorney to review your situation and advise you as to how to ensure that the spouse can qualify for Medicaid while protecting their assets.

For more information, download our complimentary Medicaid Guide HERE.

We hope you found this article helpful. Contact our office today at 1 (800) 680-1717 and schedule an appointment to discuss what makes sense for you and your loved ones.

This Post Has 0 Comments