This originally aired on the Catholic Faith Network’s show CFN Live: https://youtu.be/mUrGKFJ5NOE The Silver Tsunami…

This originally aired on the Catholic Faith Network’s show CFN Live: https://youtu.be/F-nfCxX5bVU

There may be money out there waiting for you to make a claim. One in seven have unclaimed funds in this country. There is over three billion dollars returned each year in the United States.

Here in New York, every day in the State $1.5 million dollars is returned by New York to those who make claims. NYS is holding over 848 million dollars. And your odds are better than buying a lottery ticket.

How do monies end up in Unclaimed Funds?

Generally, States require that financial institutions, insurance companies, utility providers, and other businesses to turn dormant accounts, unclaimed refunds, unclaimed dividends, unclaimed insurance proceeds, and other inactive holdings over to the State.

If there was no activity in an account for a set period of time, typically between two and five years, the asset is considered abandoned or unclaimed.

How can you find out if I have unclaimed funds?

The starting point is to go online: www.missingmoney.com

Since 2000, the National Association of State Treasurers and the National Association of Unclaimed Property Administrators worked to create a national database for unclaimed property – missingmoney.com.

This website is the only national database that is endorsed by the States to assist people with their search for unclaimed funds. On this website, you can search by your last name, first name, city and all states or for a particular state.

In addition, each state’s unclaimed property department has their own website for you to search for unclaimed funds. Anyone can lose track of their money.

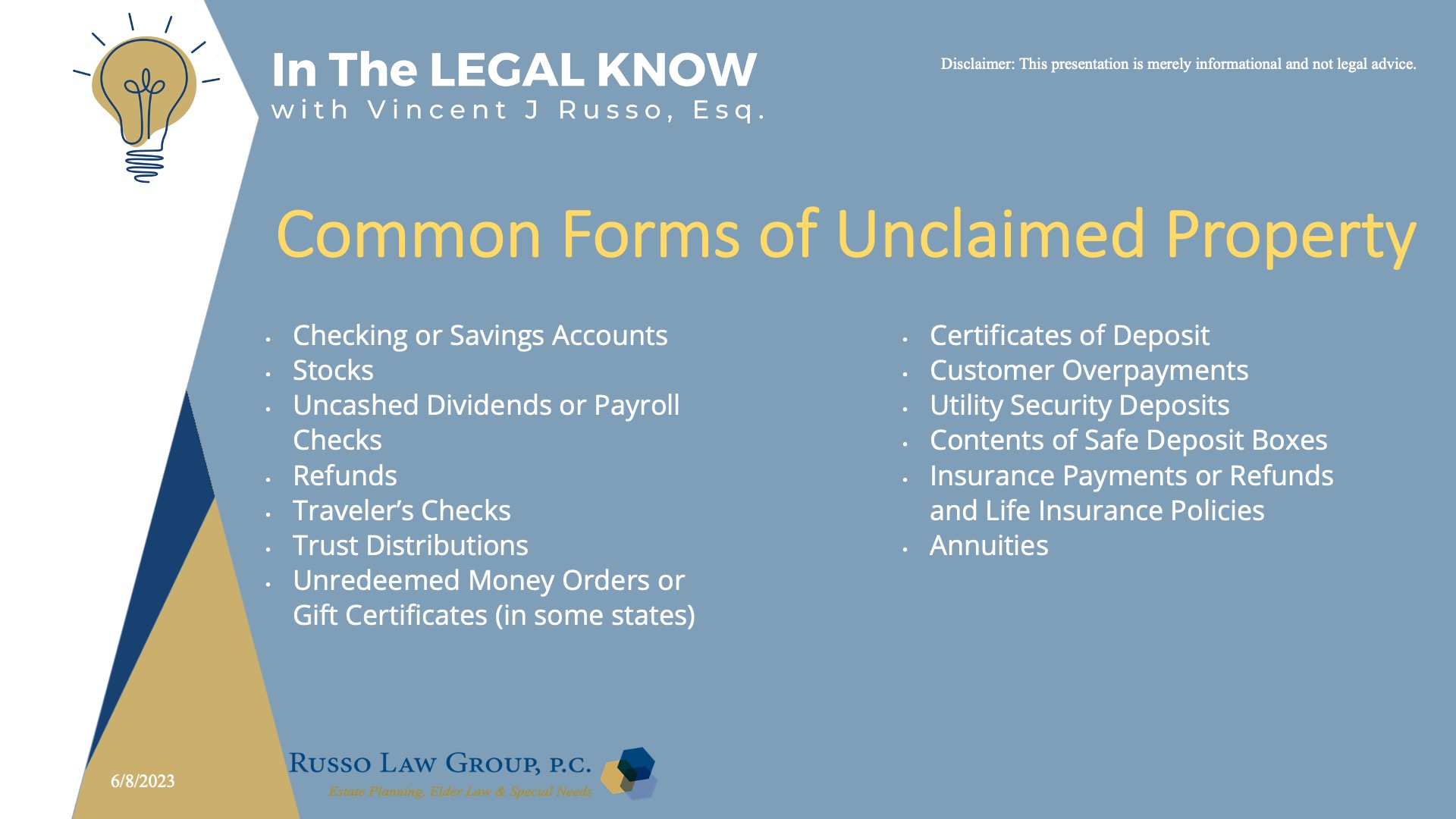

Typical examples of monies placed in unclaimed funds…

Let’s start with the most common forms of unclaimed property:

- Checking or savings accounts

- Stocks

- Uncashed dividends or payroll checks

- Refunds

- Traveler’s checks

- Trust distributions

- Unredeemed money orders or gift certificates (in some states)

- Certificates of deposit

- Customer overpayments

- Utility security deposits

- Contents of safe deposit boxes

- Insurance payments or refunds and life insurance policies

- Annuities

Bank accounts account for the majority of claims. For example, in New York 41% of unclaimed funds are from bank accounts.

Also, taxes may be an area where the IRS and the State income tax authorities are holding on to monies that should be refunded, but no tax return seeking the refund has been filed. After three years from the filing date of a return, any refund that the taxpayer is entitled to is lost. You, in effect, have made a gift to the Internal Revenue Service.

I see this issue of unclaimed funds in my law practice. When a loved one passes away, we advise the executor of the estate or family members to check with unclaimed funds on behalf of the decedent.

A loved one may not have been managing their assets properly, especially if they were dealing with a chronic or terminal illness. Accounts may have abandoned, or refund checks not cashed. One should investigate any government bonds or retirement accounts that may have existed.

In a marital situation, the husband may have been managing the couple’s assets and then fell ill, the surviving spouse may not be aware of monies that she or her husband are entitled to receive.

If I have unclaimed funds, how can I make a claim?

You can go to the state website covering unclaimed funds or abandoned property for instructions on how to file a claim for unclaimed funds. The easiest way is to do it online, but you will also have the option to file a claim by mail.

If filing online, the key is to follow the step-by-step directions and prompts that appear on the screen.

You will be asked to provide your social security number, name, telephone number, email address, and mailing address. If you file the claim online, you may receive an email asking for documentation to prove ownership.

You can also submit the claim by mail. Generally, mailed in claims take longer to process.

If your name changed, you would need to submit proof of the name change. For example, a marriage certificate, adoption paper, or divorce decree.

To make a claim on behalf of another person, you must submit proof of your connection to the owner. For example, a copy of your child’s birth certificate or legal adoption order if your child is under age 18.

If you are claiming an asset on behalf of another person by use of a Power of Attorney, you will need to submit an Affidavit from the agent under the Power of Attorney that the owner is living and that the Power of Attorney remains in full force and effect.

If the owner of the unclaimed fund is deceased, the claim must be submitted by the person appointed by the Surrogate’s Court to administer the estate (i.e. Letters Testamentary or Letters of Administration).

If there is no court appointed representative of the estate, you may be able to submit a claim if you are the surviving spouse, immediate blood relative such as a child, parent, or sibling, other blood relative such as a grandchild, niece/nephew, aunt/uncle, or cousin, or credit such as the payer of the decedent’s funeral expenses.

Tips for identifying whether you have unclaimed funds and how to get them…

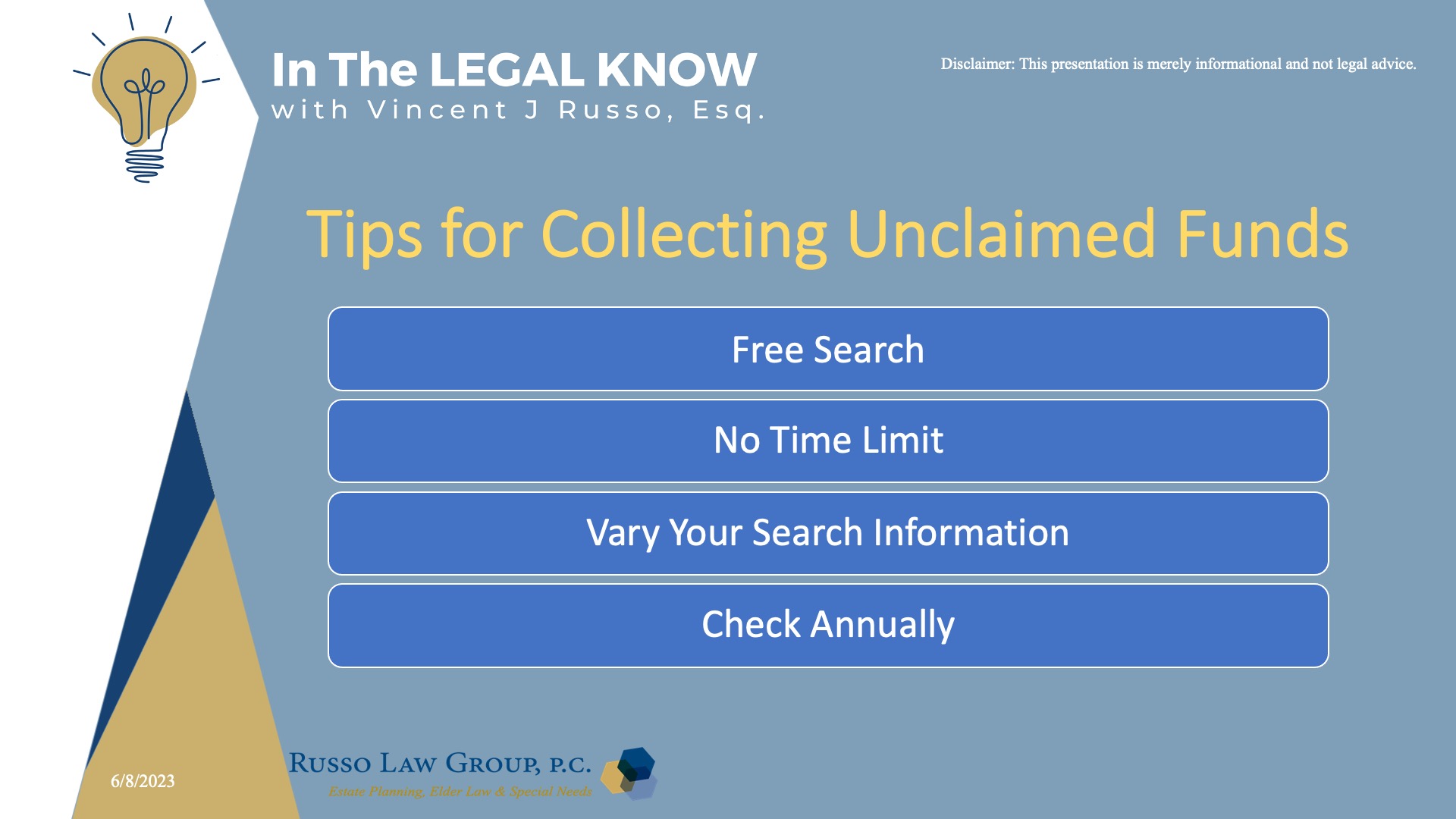

Here are my tips for unclaimed funds.

- Searching for unclaimed funds is free. You should not pay a fee to search for unclaimed funds.

- Next, there is no time limit for making a claim.

- Now for some search tips:

- Start with searching for your last name and first name. If you cannot find anything using your last name and first name, you should try the search using your last name and first letter of your first name.

- If your name is frequently misspelled or if you have documentation in which the account title was spelled incorrectly, you should try searching by the misspelled name.

- Check if there is an advanced search option. For example, in New York, if you are still unable to find your unclaimed/abandoned asset by using the last name, first name and first initial searches, you can use the Advanced Name Search option which can cover name variations and previous addresses.

- Lastly, check annually to see if any funds are being held for you in unclaimed funds.

We hope you found this article helpful. Contact our office today at 1 (800) 680-1717 and schedule an appointment to discuss what makes sense for you and your loved ones.

Comments (0)