This originally aired on the Catholic Faith Network’s show CFN Live: https://youtu.be/qjTAXRcQ13Q Navigating the complexities…

Are UTMA Accounts a Good Idea for your Minor Children?

This originally aired on the Catholic Faith Network’s show CFN Live: https://youtu.be/J9aMrXcKEO8

What is an UTMA account?

A UTMA account under the Uniform Transfers to Minors Act (UTMA) is a type of account managed by a custodian that allows minors to receive and hold gifts such as money, real estate, and fine art without needing a formal trust.

When the child beneficiary of a custodial account reaches the age of majority in your state, everything in the account will pass onto them.

How Does a UTMA Account Work?

In a UTMA account, an adult, often a parent or guardian, acts as the custodian. The custodian has full control over the account and can make investment decisions on behalf of the minor. The custodian manages the account for the benefit of the minor and can withdraw funds as needed for the child’s benefit. Once the child reaches the age of majority, the assets are transferred to their control.

The custodian can withdraw and use the UTMA funds for expenses that benefit the child. These expenses can include educational costs, medical expenses, and other needs related to the child’s well-being. However, the funds must be used in a manner that benefits the minor.

Anyone can contribute to a UTMA account, but their contribution is considered an irrevocable gift. This means only the custodian has the right to withdraw funds, and it must be for the child’s benefit. The custodian has a fiduciary duty to act in the child’s best interest.

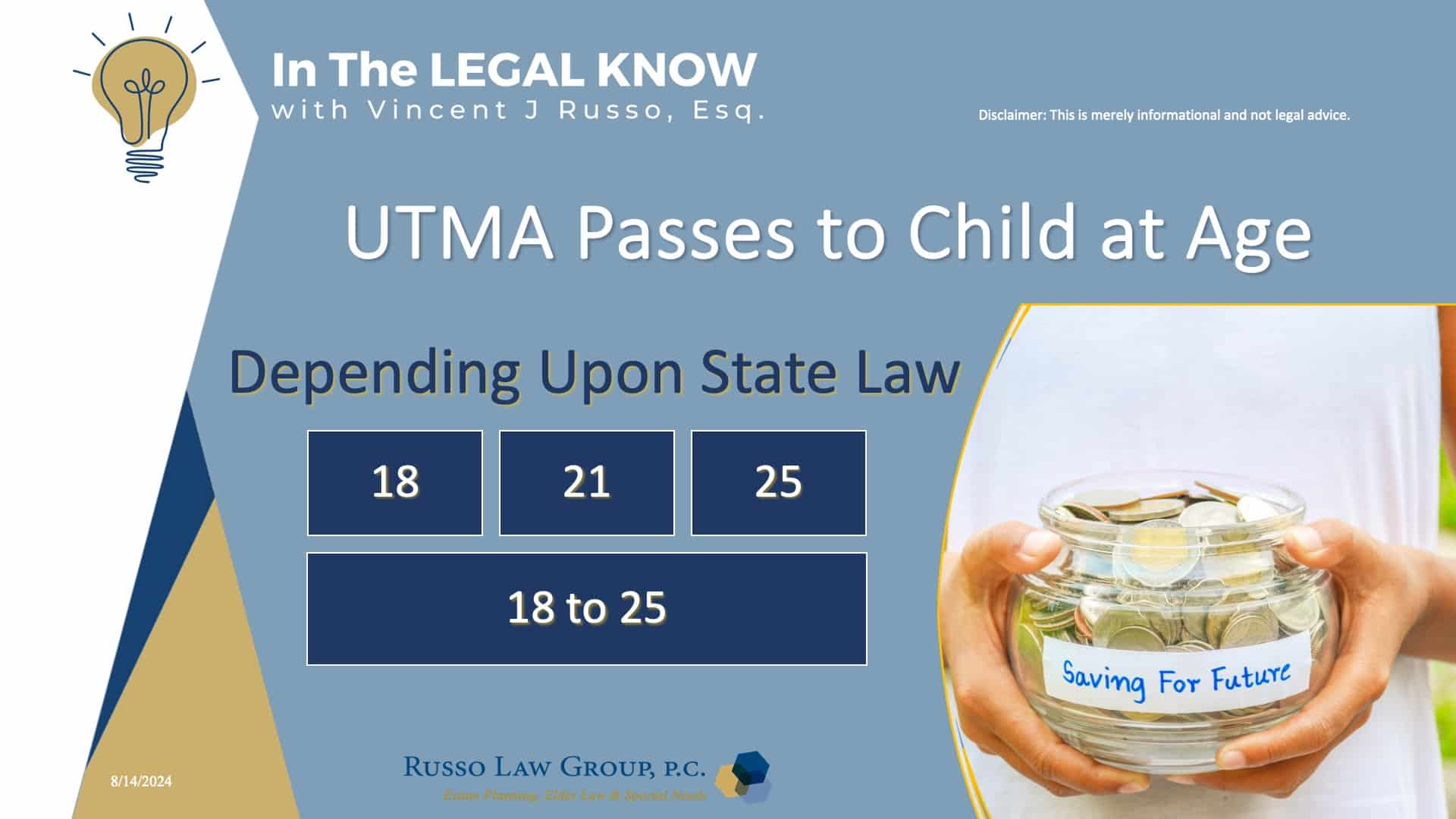

When is the child able to withdraw the UTMA funds?

The child can access and withdraw the UTMA funds once they reach the age of majority as defined by their state’s law.

Depending on the state, a UTMA account is handed over to a child when they reach either age 18 or age 21. In some jurisdictions, at age 18 a UTMA account can only be handed over with the custodian’s permission, and at 21 is transferred automatically.

Likewise, an adult can elect to maintain custodianship over the assets until the beneficiary reaches up to age 25 depending on the state in which the account exists.

The custodian can also sometimes choose between a selection of ages.

For example, in New York, the UTMA generally requires the custodian to transfer the custodial property to the minor when the minor reaches the age of 21 (unless the person creating the account, in designating the custodian, elects the age of 18 instead).

If you’re setting up an UTMA account in Florida, you’ll have different rules to think about. In Florida, you can set up an UTMA that will end when the child in your life hits any age between 21 and 25. You get to decide the precise age at which that beneficiary gains access to those assets. But if you choose anything over 21, you as the custodian need to allow the beneficiary to take ownership within a month of their 21st birthday.

In Virginia, the UTMA custodian can decide whether the beneficiary gets control of the account assets at age 18, 21, or 25.

The key takeaway here is simple. When the child in your life comes of age, everything in the UTMA custodial account you’ve created for them becomes their legal property. That’s why it’s so crucial that you fully understand the rules in your state and prepare kids for that transfer of assets.

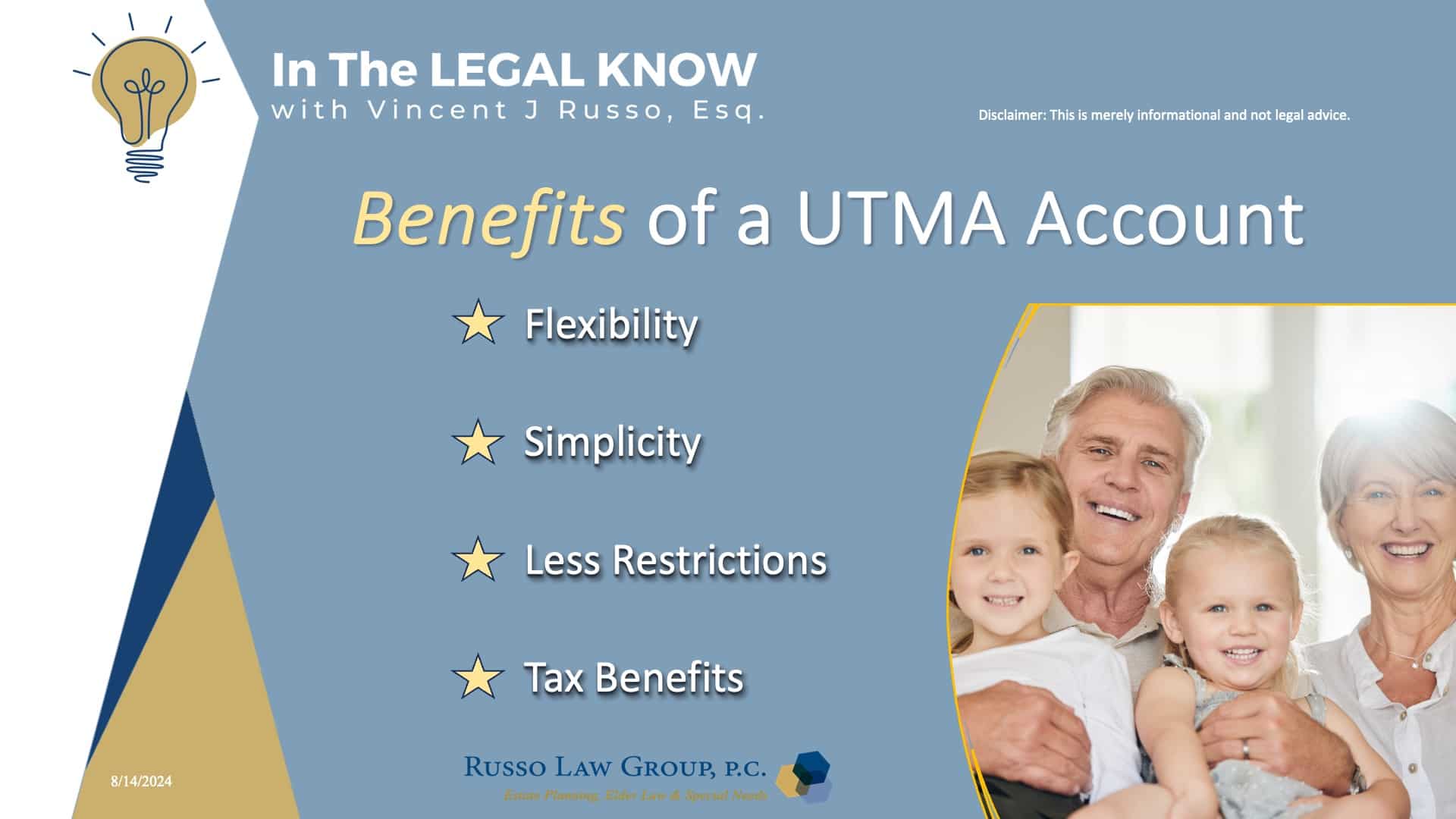

What Are the Benefits of a UTMA Account?

- Flexibility: Custodians can use the funds for a wide range of expenses benefiting the minor.

- Simplicity: Easier to set up than formal trusts.

- Less Restrictions: No contribution limits or withdrawal restrictions

- Tax Benefits: Potential tax advantages on the investment income generated within the account. For a child with no earned income, the amount of unearned income up to $1,300 is not taxed in 2024. The next $1,300 is taxed at the child’s rate. Any amount above $2,600 is taxed at the parents’ rate.

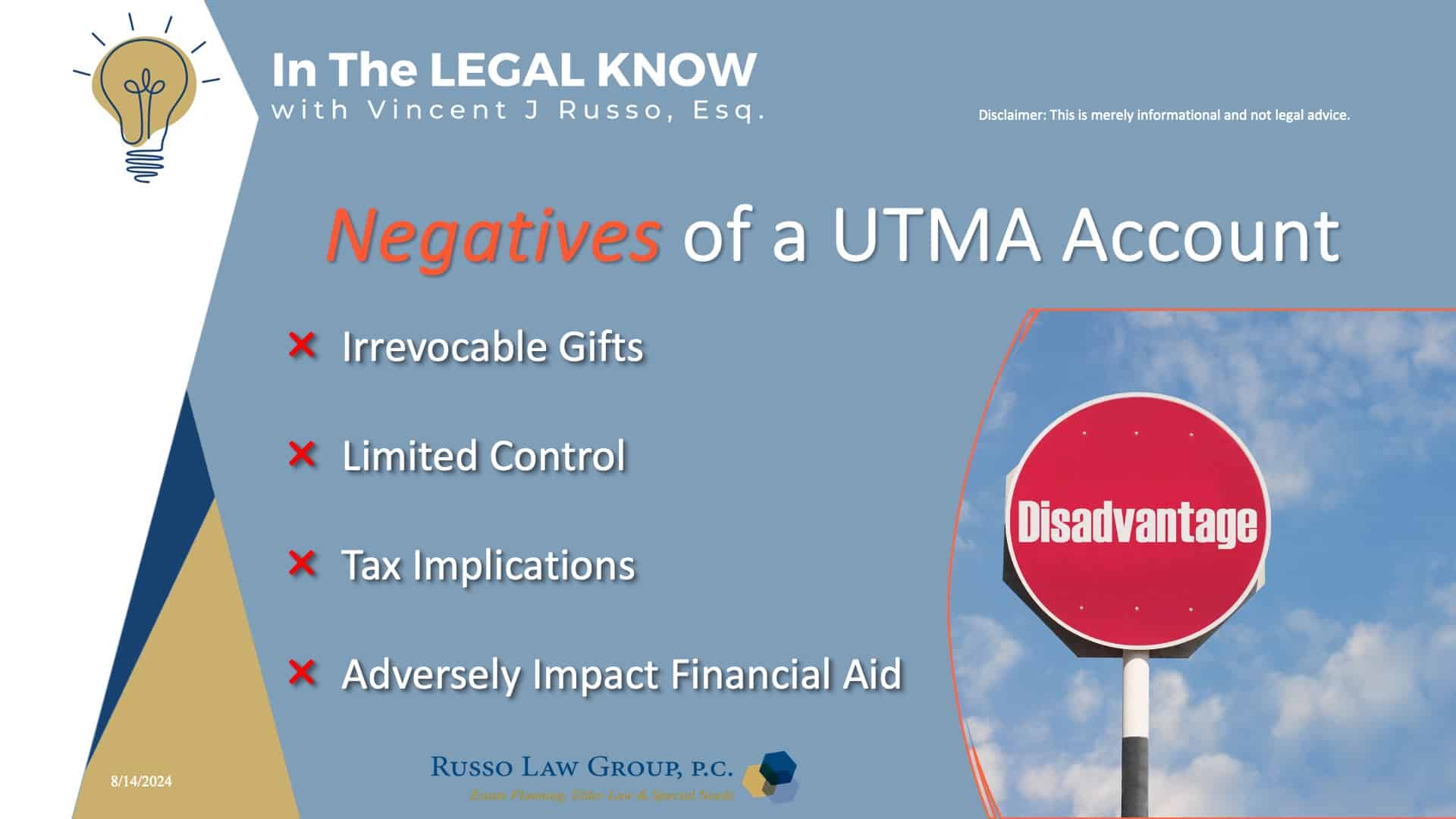

What Are the Negatives of a UTMA Account?

- Irrevocable Gifts: Once assets are placed into the UTMA account, they cannot be taken back.

- Limited Control: Upon reaching the age of majority, the minor has full control over the assets, regardless of their financial acumen.

- Tax Implications: Investment income may be subject to the “kiddie tax,” which taxes a portion of a minor’s unearned income at their parents’ tax rate.

- Adversely Impact Financial Aid: This account will be taken into account when seeking financial aid or need-based college scholarships

What Are the Alternatives to a UTMA Account?

Alternatives to a UTMA account include:

529 College Savings Plans: Tax-advantaged accounts specifically for educational expenses.

From a tax perspective, 529 plans are also generally better. Earnings in a 529 plan are tax-free as long as you use them for qualified education expenses. By contrast, the government taxes UTMA earnings above $2,600 (in 2024) at the parents’ rates (subject to the Kiddie tax rules). This could mean a big tax bill.

Since the account assets are considered theirs, UTMA and UGMA accounts are reported as such when it comes to applying for college financial aid. The child’s eligibility for aid will be reduced by 20% of their UTMA or UGMA account asset value. In comparison, 529s and Coverdells reduce aid by only up to 5.64% of the asset value because these plans are considered property of the account owner.

Roth IRAs: For teenagers who earn income and parents who wish to start retirement savings early.

Trust Accounts: Formal trusts offer more control over how and when the funds are distributed. Trusts are more protective and would make sense for larger contributions of assets.

What is the Bottom Line with UTMA accounts?

The Uniform Transfers to Minors Act (UTMA) is a law designed to allow a minor to receive gifts, including money, patents, royalties, real estate, fine art, securities and more, without the aid of a guardian or trustee.

UTMA accounts are the latest version of UGMA accounts set up under the Uniform Gift to Minors Act.

This account can be very helpful for parents managing monies of their minor children. The caveat is that the child in effect owns the funds and will have access to them at the age of majority. One needs to consider the child’s ability to manage funds, the amount of the funds and potential impact on college loans and scholarships. If the child is disabled, then a termination of the UTMA account can adversely impact the ability to properly manage the account and for the child to qualify for certain government programs (such as Medicaid or Supplemental Security Income).

We hope you found this article helpful. Contact our office today at 1 (800) 680-1717 and schedule an appointment to discuss what makes sense for you and your loved ones.

Comments (0)