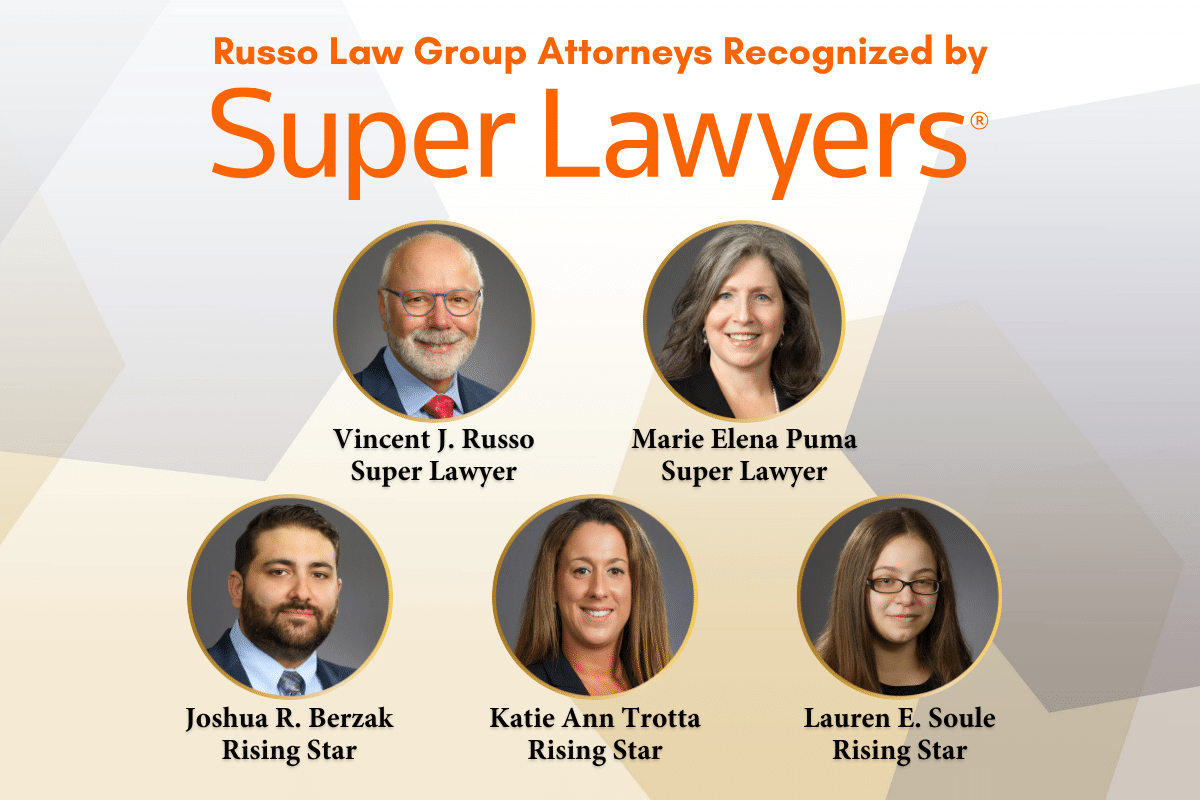

We are proud to announce that five attorneys from Russo Law Group have been selected…

In my experience (Deanna M. Eble, Esq.), one of the biggest concerns for clients, especially seniors, is that they do not want to lose their home to long-term care costs.

An Example

Recently I met with Sal. He has two children and always thought that when he passed his children would inherit the home that he and his wife worked so hard to maintain. Sal has been a widow for three years now and he is starting to feel his age (82). Sal came to my office to see what options he has to protect his house. He had been talking to his friends and neighbors and was concerned about the horror stories he was hearing about people who ultimately lost the home value to long-term care costs.

Determining Goals

At the start of our discussion, Sal and I first had to determine what his goals were and what his comfort levels were. I explained that based on his needs and wants, we could come up with a plan to help achieve his goals.

Option 1 – Irrevocable Trust

Transfer the home into an irrevocable trust. The transfer of the home into the irrevocable trust will be subject to a Medicaid nursing home penalty if Sal needs nursing home care within the next 5 years. If properly written, Sal will have the right to live in his home for his lifetime. With the proper language in the trust, Sal will also maintain his real property tax exemptions (i.e., Veteran’s and enhanced STAR).

When your home is owned by a Trust, the trustees are not the “owners”. The Trustees are just managing the assets in the trust. This is an important detail to understand because this means that the trust isn’t subject to the trustee’s financial or personal turmoil.

Option 2 – Transfer Ownership

Transfer the home to Sal’s children (or other family members) and Sal would maintain a “life estate” on the property. The transfer of the home with a life estate will also be subject to a Medicaid nursing home penalty if Sal needs nursing home care within the next 5 years (with some exceptions). The life estate on the property will allow Sal to live in the home for his lifetime. Sal’s children cannot sell the home in his lifetime without his permission. This will also ensure that Sal maintains any property tax exemptions that he is currently receiving such as Veteran’s exemption and enhanced STAR.

When considering this second option, the caution is that Sal’s children become owners of the property. This can be problematic should they have financial problems or if they are in a bad marriage (now, or in the future). I have even had the issue with a child predeceasing the parents and then the home has to pass through probate of that child’s estate.

Other Options

Further discussion was had with regard to other options such as doing nothing at this time or putting the home into a revocable trust. Sal understood that neither of these options would protect the value of the home from long-term care costs, but would make it very easy to apply for a reverse mortgage if he wanted to pay for his care in the future.

It is important to meet with an experienced elder law attorney who can listen to your goals and advise you as to your options in obtaining those goals in the best way possible.

Comments (0)