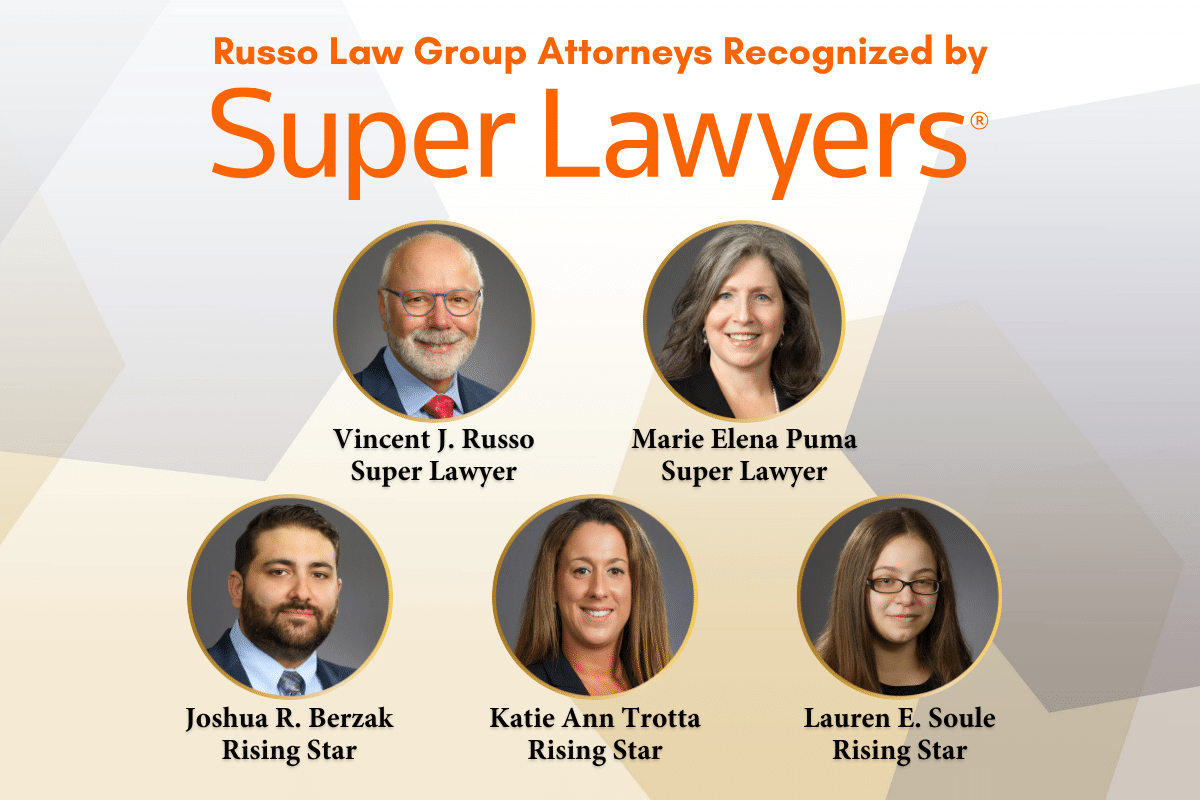

We are proud to announce that Russo Law Group has once again been recognized in…

How do you get the Social Security Administration (SSA) to listen to you when you act on behalf of a loved one?

Good question!

Recently, one of our clients wanted to change the home address for her husband, who couldn’t make the request directly. The SSA refused to act on her request stating that she must be a representative payee.

But she didn’t want to change where the check was deposited or get a check payable to her as a representative payee. What could she do?

The solution was to name her an authorized representative on the account, not a representative payee. Our estate planning and elder law attorneys explain the difference.

What is an Authorized Representative?

An authorized representative is an attorney or other qualified individual appointed by a claimant to represent them when doing business with SSA. More than one authorized representative may be appointed to a claimant.

All authorized representatives who come before the SSA must comply with the Rules of Conduct and Standards of Responsibility for Representatives.

The appointment for an authorized representative must be in writing and filed with SSA. The authorized representative can’t charge or collect a fee for services without written approval from the Social Security Administration, even if a claim is denied.

What is a Representative Payee?

A representative payee is an individual or organization appointed by the Social Security Administration (SSA) to receive Social Security and/or SSI benefits for someone who can’t manage or direct someone else to manage their money.

A representative payee is charged with using the benefits to pay for the beneficiary’s current and foreseeable needs and properly save any benefits that exceed their current needs. A representative payee is responsible for maintaining records of expenses and must provide the SSA with an accounting of how benefits were used or saved upon request. You can’t collect a fee for being a representative payee unless you are a qualified organizational payee who has received written approval from SSA.

Should You Be an Authorized Representative or Representative Payee?

If you are conducting business with the SSA on behalf of a loved one, becoming an authorized representative is necessary.

If you care for minor children or incompetent adults the law requires you to be a representative payee to manage the account. Unless an exception applies, you must complete the representative payee application in a face-to-face interview. To become a representative payee, you must submit an application, form SSA-11, and documents to prove your identity.

Russo Law Group, PC, can help you apply to act as an authorized representative or a representative payee. Consult with and retain knowledgeable estate planning attorneys in New York to get legal services and advice about estate planning, elder law, and government benefits.

For more information about social security or to review or update your estate plan, we invite you to contact our law firm to speak with one of our experienced elder law and estate planning attorneys in New York at 1 (800) 680-1717.

Comments (0)