Watch “In The Legal Know” with Vincent J. Russo Vincent appeared on CFN Live on…

This originally aired on the Catholic Faith Network’s show CFN Live: https://youtu.be/qjTAXRcQ13Q

Navigating the complexities of Medicare can be daunting, and Seniors are confronted with making decisions regarding their health care coverage during the current Medicare Open Enrollment period. Before we get into the enrollment period, lets get a high-level explanation of Medicare coverage.

Navigating the complexities of Medicare can be daunting, and Seniors are confronted with making decisions regarding their health care coverage during the current Medicare Open Enrollment period. Before we get into the enrollment period, lets get a high-level explanation of Medicare coverage.

First, we start with Original Medicare which includes Medicare Part A (Hospital Insurance) and Part B (Medical Insurance).

- You can join a separate Medicare drug plan to get Medicare drug coverage (Part D).

- You can use any doctor or hospital that takes Medicare, anywhere in the U.S.

- To help pay your out-of-pocket costs in Original Medicare (like your 20% coinsurance), you can purchase supplemental coverage (sometimes called “Medigap Insurance”)

Or you can join a Medicare Advantage Plan (also known as Part C). A Medicare advantage plan is a Medicare-approved plan from a private company that offers an alternative to Original Medicare for your health and drug coverage. These “bundled” plans include Part A, Part B, and usually Part D (which is optional a Medicare prescription drug benefit).

What does it mean for seniors that they are in the Medicare Open Enrollment?

Every year there are changes to Medicare, Medicare Advantage Plans and Medicare Prescription Drug Plans (PDPs). 2025 is no exception.

During this time, people with Medicare can review features of Medicare plans offered in their area and make changes to their Medicare coverage, which go into effect on January 1st of the following year. These changes include switching from traditional Medicare to a Medicare Advantage plan (or vice versa), switching between Medicare Advantage plans, and electing or switching between Medicare Part D prescription drug plans.

Medicare Open Enrollment is essential because your healthcare needs change over time. What worked last year might not be the best option this year. By reassessing your plan, you can potentially save money, gain better coverage, or find a plan that includes your preferred healthcare providers. With rising healthcare costs, taking advantage of this period can lead to significant financial and health benefits.

Key Dates to Remember

We are now in the annual open enrollment period for Medicare.

- The period runs from October 15th to December 7th

- This is referred to as the Medicare Open Enrollment Period

It is important to note that there are five enrollment periods available to seniors and people with disabilities, depending upon whether one meets the criteria for that enrollment period.

What steps should seniors take in the open enrollment period?

Review Your Current Plan

By now, Medicare recipients should have received your Annual Notice of Change (ANOC) from their current health plan, detailing any adjustments to your coverage.

Some plans may be discontinued, and there will likely be changes to premiums, formularies, and provider networks. These changes could directly impact your healthcare costs and the coverage you rely on.

Before making any changes, it’s important to understand how well your current plan is serving you. Ask yourself these questions:

- Are my current healthcare providers covered?

- Are my medications included in the plan’s formulary?

- Have my healthcare needs changed?

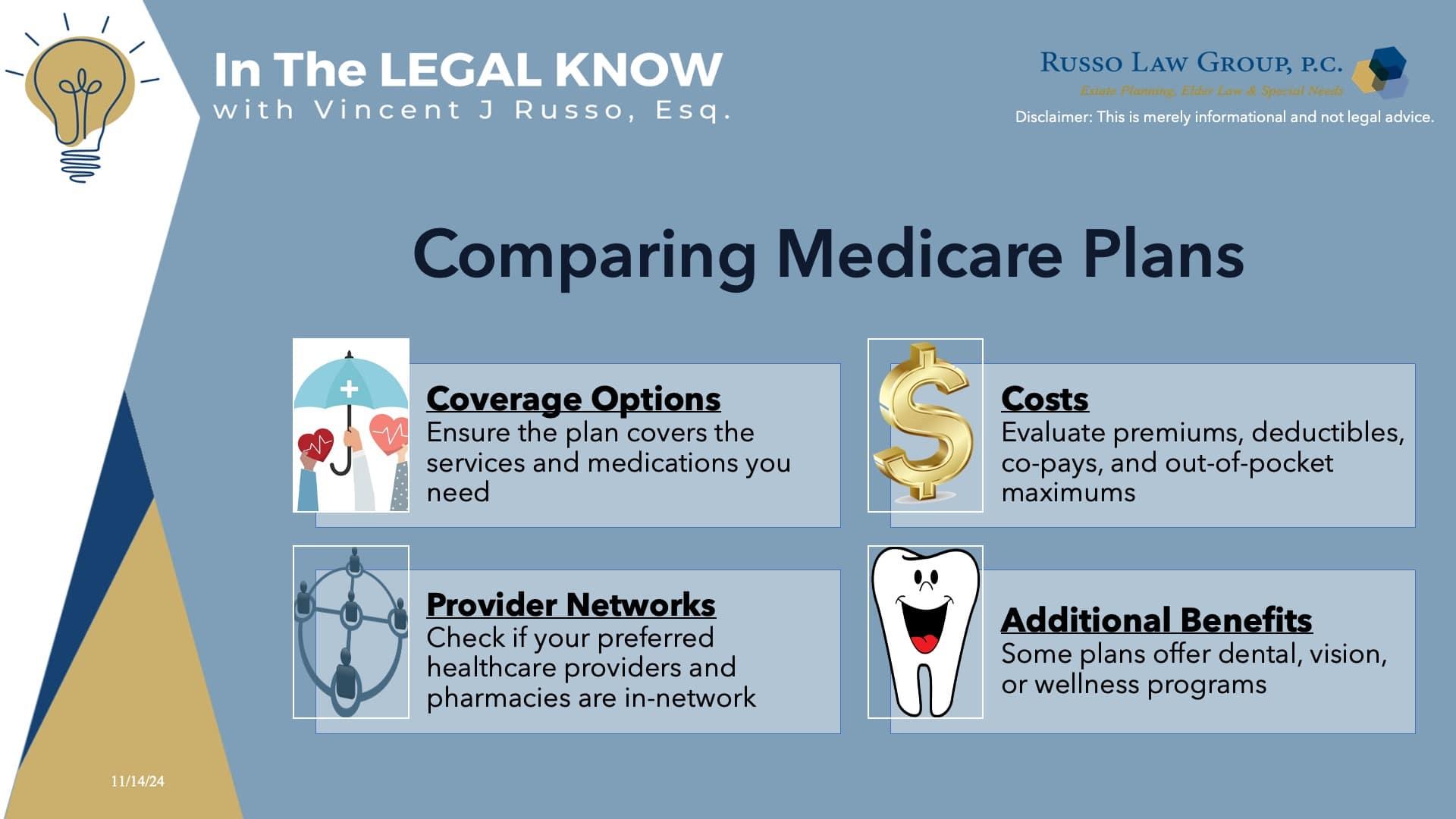

Comparing Medicare Plans

One of the most critical steps in the Medicare Open Enrollment process is comparing different plans.

Look out for:

- Coverage Options – Ensure the plan covers the services and medications you need.

- Costs – Evaluate premiums, deductibles, co-pays, and out-of-pocket maximums.

- Provider Networks – Check if your preferred healthcare providers and pharmacies are in-network.

- Additional Benefits – Some plans offer dental, vision, or wellness programs.

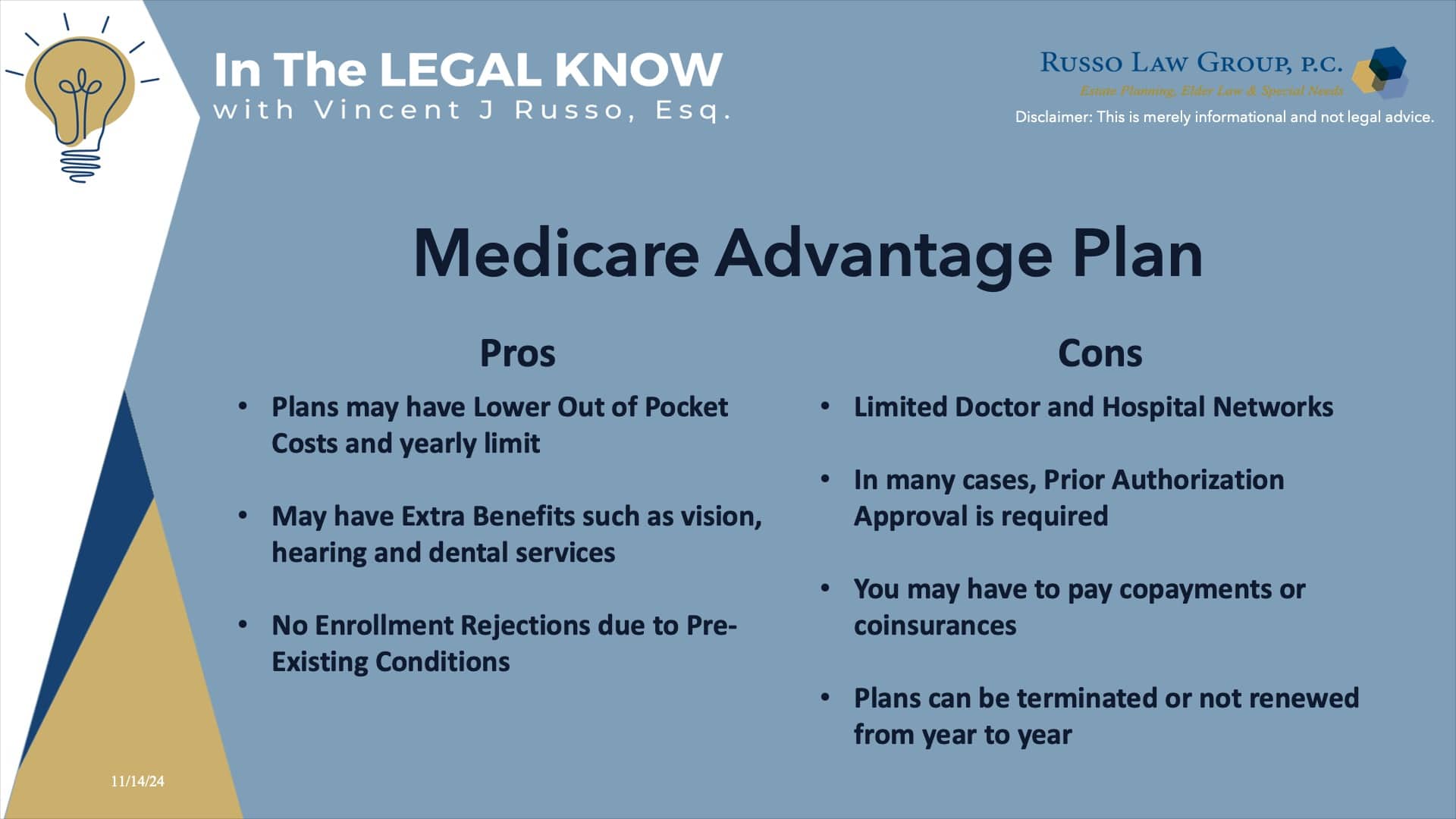

What are Pros and Cons of Medicare Advantage Plans?

Medicare Advantage Plans, also known as Part C, are an alternative to Original Medicare. These plans are offered by private insurance companies approved by Medicare and often include additional benefits. However, they might have different network restrictions and cost implications.

Medicare Advantage is a Medicare-approved plan from a private company that offers an alternative to Original Medicare for your health and drug coverage. These “bundled” plans include Part A, Part B, and usually Part D.

Pros of Medicare Advantage Plans

- Plans may have lower out-of-pocket costs than Original Medicare.

- Plans may offer some extra benefits that Original Medicare doesn’t cover—like vision, hearing, and dental services.

- No enrollment rejections due to pre-existing conditions

- Better satisfaction levels and coordinated care than Original Medicare

Cons of Medicare Advantage Plans

- Limited Doctor and Hospital Networks. In most cases, you can only use doctors who are in the plan’s network.

- Prior Authorization Runarounds. In many cases, you may need to get approval from your plan before it covers certain drugs or services.

- A Lower Likelihood of receiving top-flight care

- Snag switching between Traditional Medicare and Medicare Advantage

What is Medicare Part D?

One should also look at Prescription drug coverage (Part D). Medicare drug coverage helps pay for prescription drugs you need. It’s optional and offered to everyone with Medicare.

Prescription drug coverage, or Part D, can be crucial for managing healthcare costs. During Open Enrollment, ensure your medications are covered and look for plans that offer better pricing or additional support for managing drug therapies.

Making Changes to Your Medicare Plan

You can switch from Original Medicare to a Medicare Advantage Plan, move from one Medicare Advantage Plan to another, or change your Part D plan. You can use the Medicare Plan Finder to enroll in the new plan directly.

Please note that the Annual Enrollment Period ONLY applies to Medicare Advantage and Medicare Prescription Drug Plans. If you have a Medicare Supplement (Medigap) plan, you DO NOT need to act during this period.

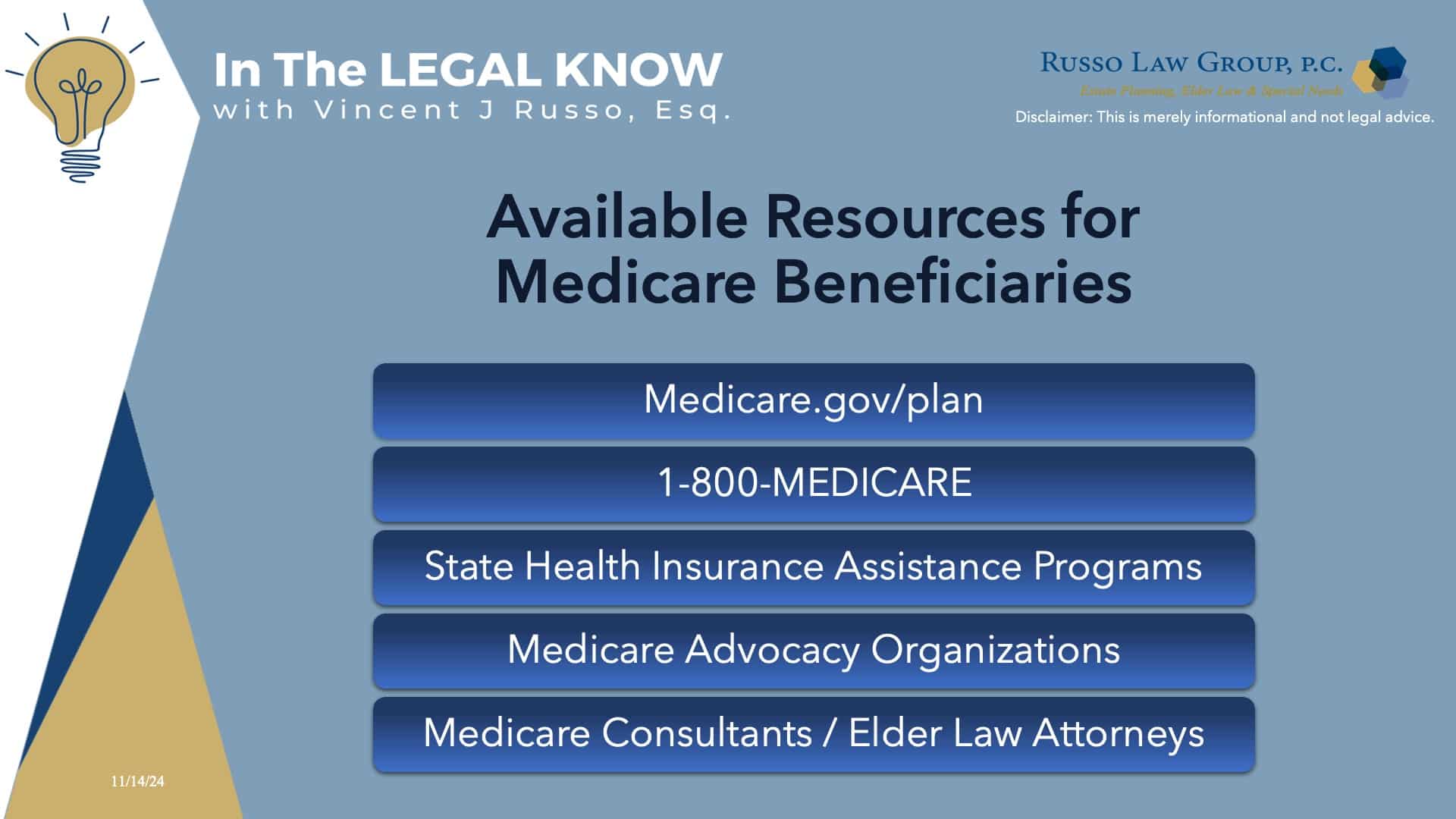

What resources are available to Medicare Beneficiaries?

There are several resources available to Medicare Beneficiaries:

- Visit https://Medicare.gov/plan or call 1-800-MEDICARE

- SHIPs (State Health Insurance Assistance Programs): SHIPs are state programs that get money from the federal government to give local health insurance counseling to people with Medicare at no cost. SHIPs aren’t connected to any insurance company or health plan. You can find the phone number for your state’s SHIP by visiting https://shiphelp.org, or by calling 1-800-MEDICARE.

- Medicare Rights Center: https://www.medicarerights.org/

- Center for Medicare Advocacy: https://medicareadvocacy.org/

- Medicare Consultants and Elder Law Attorneys

Navigating Medicare Open Enrollment can be complex, and making the wrong choices could leave you without essential coverage for unexpected challenges. Seniors should seek the assistance of professionals who can advise you on the best plan for you.

We hope you found this article helpful. Contact our office today at 1 (800) 680-1717 and schedule an appointment to discuss what makes sense for you and your loved ones.

Comments (0)