The confetti has settled, the champagne glasses are put away, and the calendar has flipped…

Did you know that 50% of marriages in this country end in divorce? Subsequent marriage divorce rates are even higher; 60% for second marriages and 73% for third marriages. These statistics cannot be ignored. So how do you protect your child’s inheritance from divorce? You should consider proper estate planning.

Although New York State law does consider an inheritance “separate property” in the event of marital dissolution, this law should not be solely relied upon. If, for example, your child inherits $250,000, and keeps those funds segregated from their spouse, it should not be included as part of a divorce settlement. However, if your child creates a joint account with their spouse and deposits (some or) all of the funds, the otherwise separate property has now been inadvertently converted to marital property and is subject to the equitable distribution formula. Similarly, if you leave your summer home to your daughter, even if she retains the deed in her name alone, her spouse may have helped to improve the property by installing windows, re-tiling the bathroom, planting a garden, etc. This property may now be considered co-mingled with marital property and included as a marital asset in their divorce.

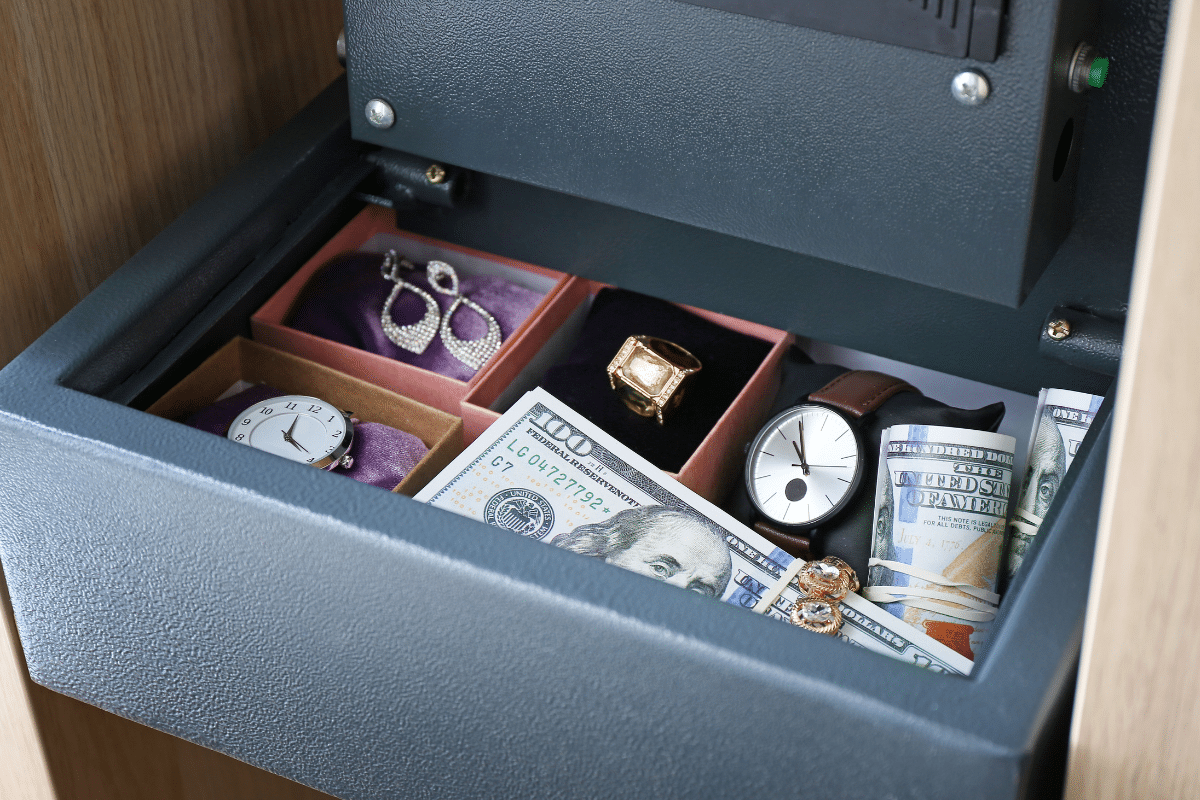

In meeting with clients, a common consensus is that most of them do not want their hard-earned money passing to their child’s spouse. Although at this time, you may have a harmonious relationship with your child’s spouse, that can easily and rapidly sour. In addition, if your child’s spouse remarries, your funds may be used for them to start a new life … without your child. Sentimental family heirlooms such as jewelry and artwork are some tangible items that a parent may want to safeguard to ensure that it remains in their direct bloodline and are passed down to future generations.

The following are some simple estate planning strategies to protect your child’s inheritance from unintended consequences:

Prenuptial Agreement

A Prenuptial Agreement is a contract between two parties prior to getting married. It identifies each party’s property going into the marriage. It specifies how property (including an inheritance) is divided in the event of a marital separation, dissolution, and death. You should urge your child to obtain a prenuptial agreement prior to marriage and consult with an estate planning attorney upon the receipt of an inheritance to engage in asset protection planning.

Lifetime Trust

This Trust is also sometimes referred to as a “Safe Trust” or “Inheritance Trust”. A great option is for you to create a lifetime trust for your child in your Last Will & Testament or Trust. Income and/or Principal would be available to provide your child with funds necessary to support their Health, Education, Maintenance, and Support (HEMS) for his/her lifetime. Additional flexible provisions can also be included to provide for luxury items and general happiness. If any funds are remaining upon the death of your child, you can still control the disposition by naming a remainder beneficiary (i.e- your grandchildren). An added benefit to this structure is that while the funds are held in Trust, the corpus is also insulated from any of your child’s creditors.

If you do not like the idea of your child not receiving the funds outright during their lifetime, then another option is to stagger a principal distribution to your child in stages (i.e.- 1/3rd of the principal at age 30, ½ of the remaining principal at age 40, and the balance at age 50). However, once the distribution is made, that sum is then subject to your child’s marital and creditor issues.

Limited Liability Companies (LLC)

The creation of an entity may also be a planning strategy for investment real estate properties. In this instance, your child may be named as a member of the LLC rather than a titleholder on the deed.

The reality is… divorce happens! As a parent, you have protected your child from others since birth and proper estate planning can extend monetary protection for their entire lifetime. It is equally important for you to preserve your own legacy for your descendants. Please contact us to discuss a specifically tailored plan to meet your family’s needs.

Comments (0)