In this segment, Vincent J. Russo discusses vital strategies every landlord needs to shield their personal assets. Discover how moving your rental properties into Limited Liability Companies (LLCs) can create a powerful fortress around your wealth, ensuring that a single accident doesn't lead to financial ruin.

This originally aired on the Catholic Faith Network’s show CFN Live: https://youtu.be/YD_gAJVgzFc

42.2 percent of all US households have IRA accounts, which equates to 55.5 million US Households. IRAs are an important component to retirement planning, but what if you need cash flow today?

Why IRAs are important?

With IRAs, you have the advantage of growing your assets while deferring paying taxes if you don’t plan on making withdrawals before age 59½. IRAs are designed for long-term investing, but some savers opt to tap their accounts before retirement. While an early withdrawal can provide you with much-needed cash flow, it can have significant financial consequences.

When can funds be withdrawn from an IRA?

Accessing IRA Funds

You can start withdrawing funds from your IRA without penalties when you reach the age of 59 1/2. Withdrawals from a Traditional IRA are taxed as regular income at your current tax rate. Roth IRA withdrawals are tax-free if you’ve held the account for at least five years due to their post-tax contribution nature.

Early Withdrawal Penalties

Withdrawing funds from your IRA before reaching the age of 59 1/2 typically results in a 10% early withdrawal penalty on top of the income taxes that may apply for a traditional IRA. There are no income taxes on an early withdrawal from a Roth IRA.

Example of Tax Consequences of an Early IRA Withdrawal

Here’s an example to illustrate just how much that may cost. Assume you’re 50 years old and withdraw $50,000 from your traditional IRA. You fall into the 24% income tax bracket, which means you owe approximately $12,000 on the withdrawal. You’d also owe an additional $5,000 for the early withdrawal penalty, resulting in a total tax bill of $17,000. That’s a steep premium to pay.

Whether you will pay an early withdrawal penalty hinges on the circumstances of your IRA withdrawal. There are notable exceptions that allow you to avoid this penalty.

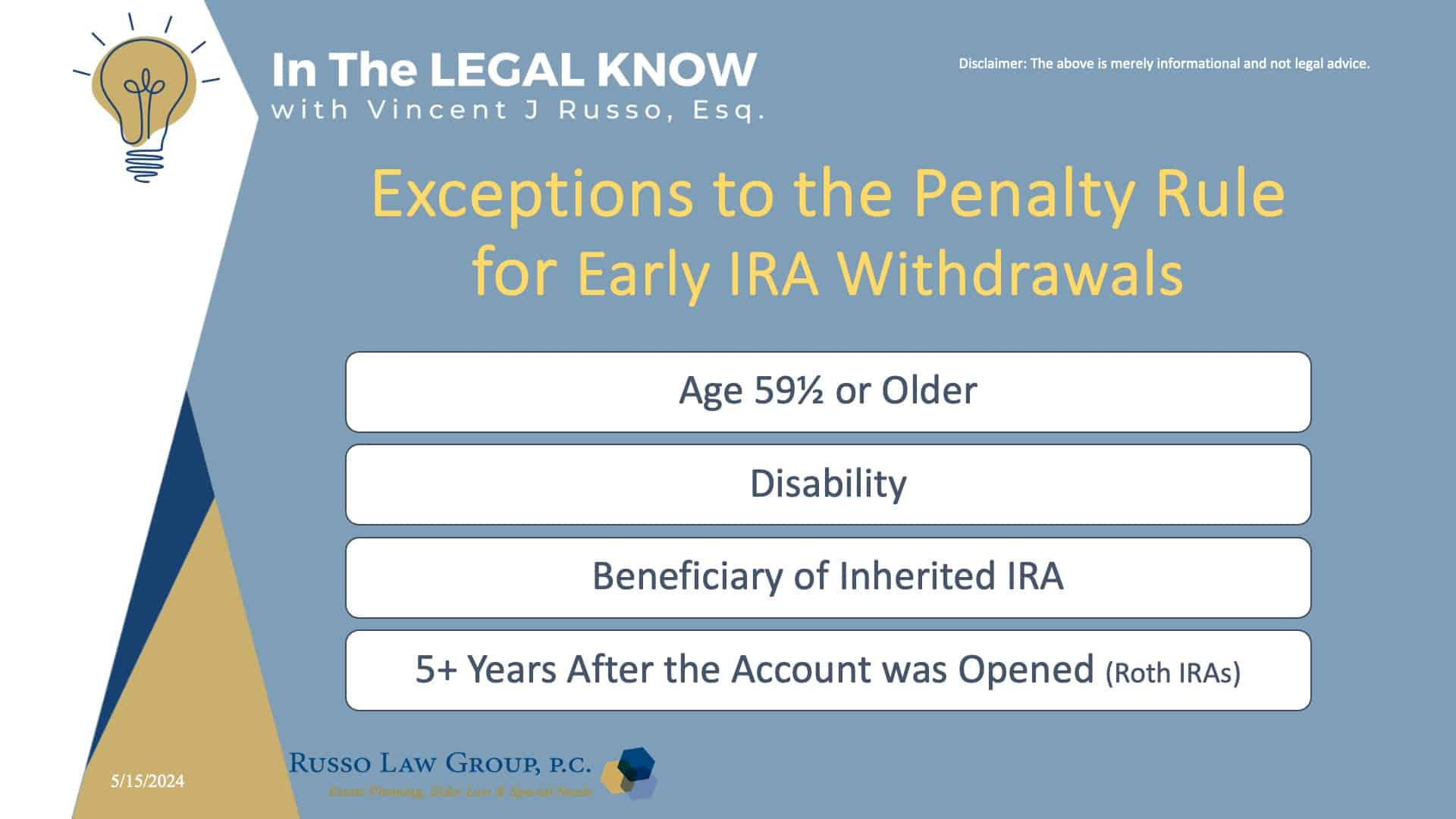

Are there any exceptions to the early withdrawal penalty of ten (10%) percent?

IRA Early Withdrawal Rules

Distributions that are not subject to a penalty are sometimes referred to as qualified distributions. There are two types: distributions when a particular condition has been met or distributions for a designated purpose.

Let’s first look at distributions that are not subject to a penalty when a particular condition has been met.

Exceptions to the Penalty Rule for Early IRA Withdrawals

- Taken at age 59½ or older.

- Taken because of a disability.

- Taken by a beneficiary after the death of the account owner.

- Taken five or more years after the account was opened (for Roth IRAs only)

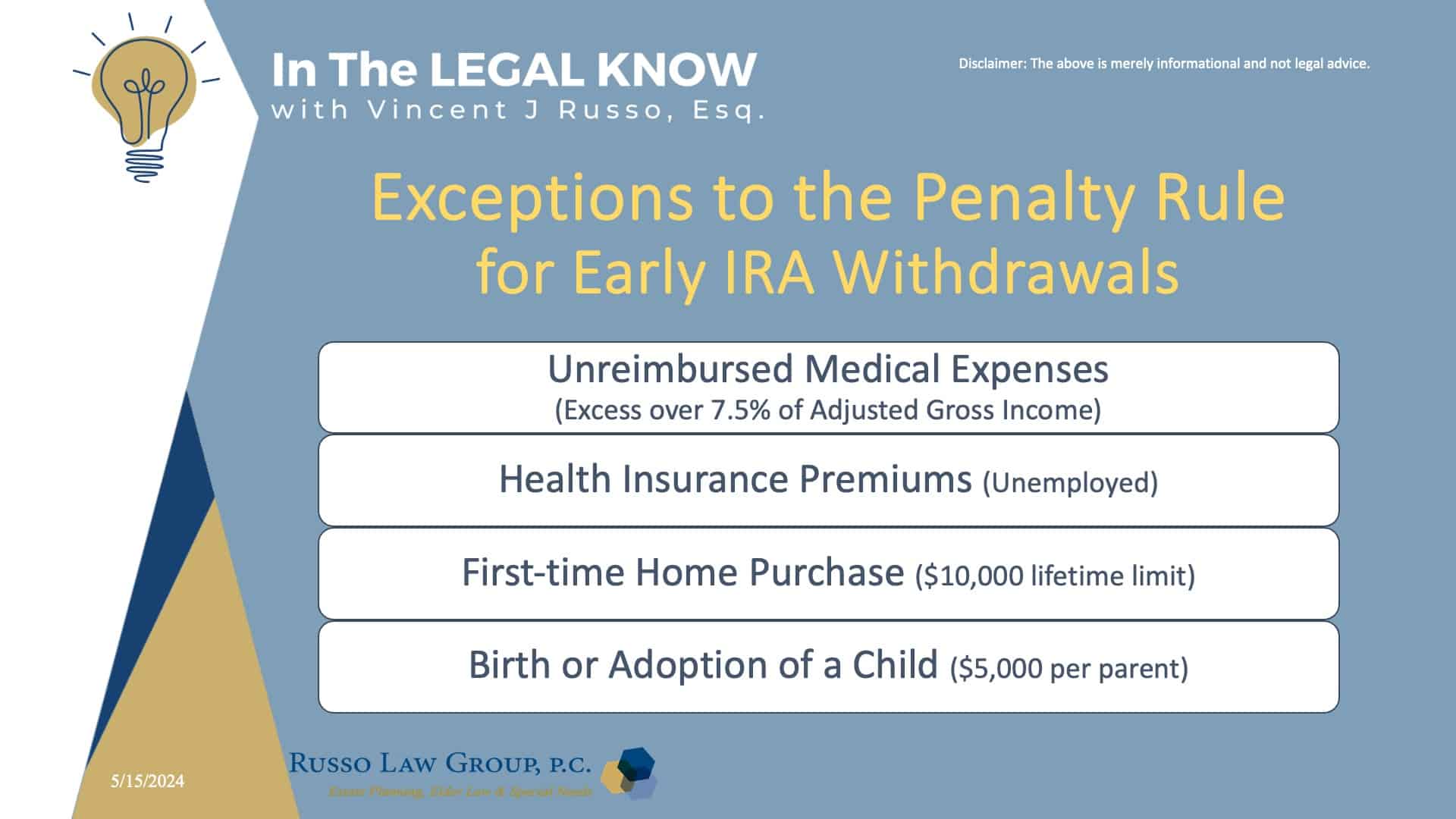

What are some designated exceptions?

There are four exceptions based on using the funds for a specific purpose:

Exceptions to the Penalty Rule for Early IRA Withdrawals

- Using the funds for unreimbursed medical expenses that are more than 7.5% of your adjusted gross income.

- Paying for health insurance premiums while unemployed.

- First-time home purchase, up to a $10,000 lifetime limit.

- Birth or adoption of a child, up to $5,000 per parent.

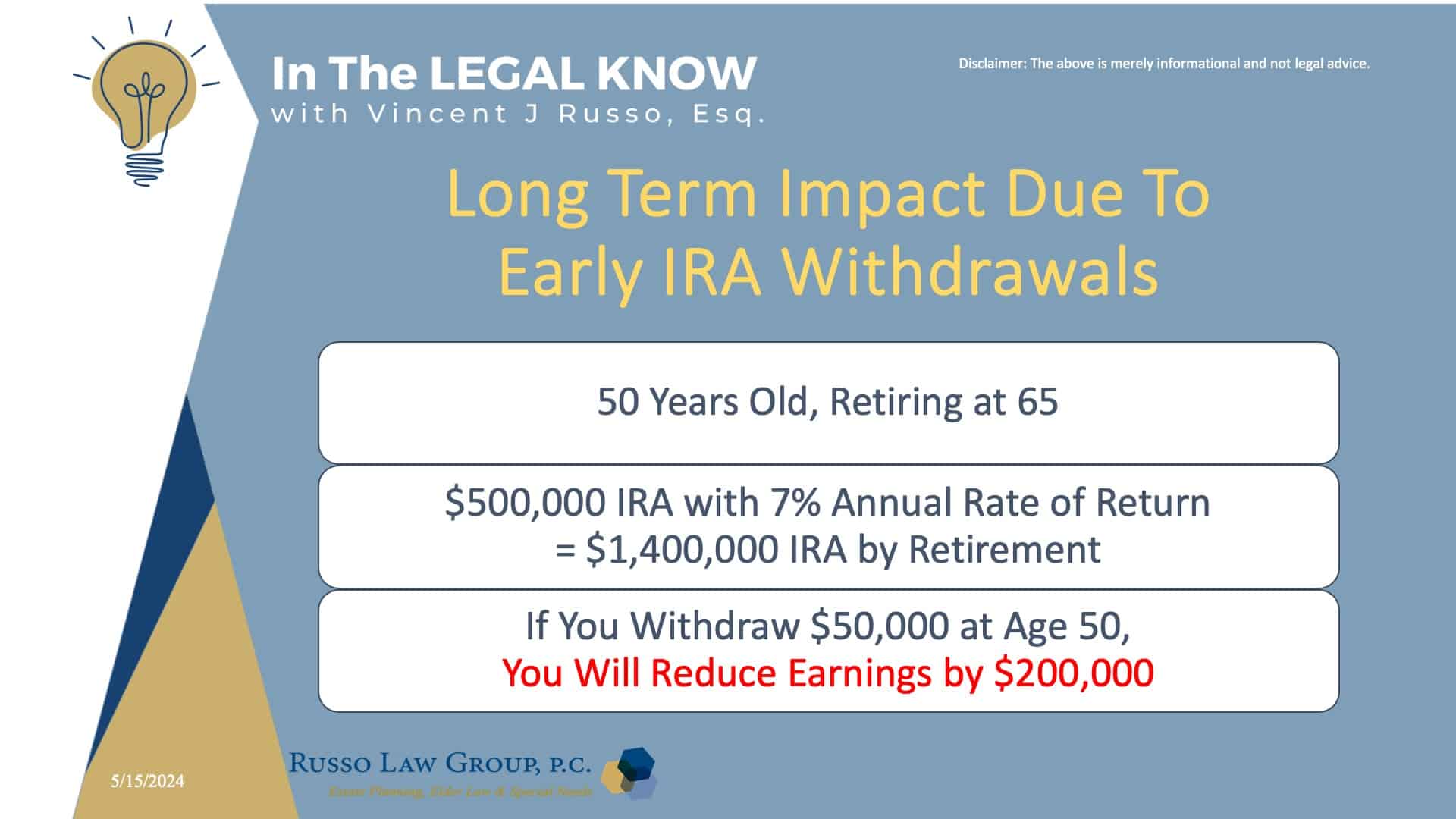

What is the long-term impact of early withdrawals on an IRA account?

Aside from the tax impact, you must also consider whether an early IRA withdrawal might shortchange your long-term savings goals.

Tapping an IRA early will often lead to a lower retirement lifestyle upon retirement. If you reduce the size of your chicken, you will reduce the size of your eggs, meaning you will reduce your income-generating assets for retirement.

Example: Long Term Impact due to Early IRA Withdrawals

Here’s another example. Say you’re 50 years old, with $500,000 in your IRA. You plan to retire at age 65, and your assets are currently earning a 7% annual rate of return. If you don’t contribute anything further to your IRA, your account could grow to nearly $1.4 million by retirement. Withdrawing $50,000 at age 50, however, would trim almost $200,000 in lost earnings off your savings total.

One should consider other borrowing alternatives, such as a home equity loan, which would allow you to maximize your retirement savings. Some of the advantages of a home equity loan would be: (i) avoid income taxes, (ii) avoid the early withdrawal penalty and (iii) the interest paid may be deductible if used to substantially improve your primary residence.

While they each have pros and cons, credit cards, personal loans, or borrowing from friends and family can also provide needed funds in the short-term.

It is usually without exception that early tapping of an IRA should be the last resort, only after all other options have been fully exhausted.

It is important to think twice before tapping your IRA. Saving for retirement can guarantee you peace of mind in your retirement years.

We hope you found this article helpful. Contact our office today at 1 (800) 680-1717 and schedule an appointment to discuss what makes sense for you and your loved ones.

Comments (0)