Watch “In The Legal Know” with Vincent J. Russo Vincent appeared on CFN Live on…

This originally aired on the Catholic Faith Network’s show CFN Live: https://youtu.be/ruO7TWFOXAY

What is a Revocable Living Trust?

A living trust is an agreement which allows you to place your assets into a trust but still use them during your lifetime. Your beneficiaries inherit them after your death.

A revocable living trust (sometimes known as an inter-vivos trust) provides many advantages that may make it a desirable part of your estate planning process.

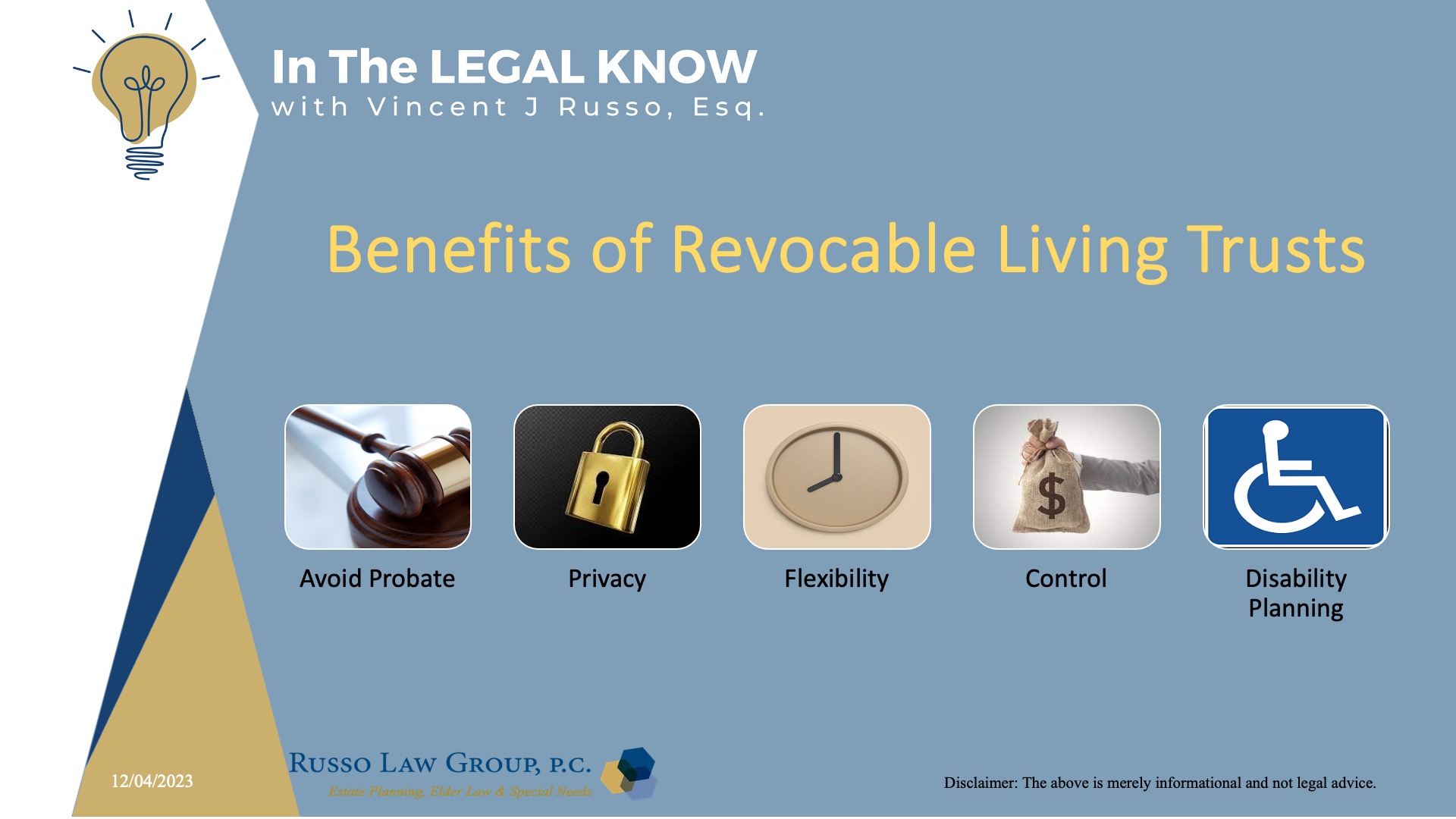

What are the Benefits of having a Revocable Living Trust?

There are five key benefits for having Revocable Living Trusts:

- Avoiding Probate: One of the primary advantages of a revocable living trust is that it can help to avoid the probate process, which can be lengthy, costly, and public. Assets in the trust can pass to beneficiaries without the need for court intervention. Keep in mind that if you just have a Will in place your estate will likely have to go through some form of Probate.

- Privacy: A living trust can be a private document and is not part of the public record, unlike a will that becomes public after being submitted to probate court. There is no public directory of trusts.

- Flexibility: A revocable living trust is flexible and can be changed or revoked by the grantor (the person who sets up the trust) at any time while they are alive and have the legal capacity to make decisions. This allows the grantor to adapt the trust to their changing circumstances, such as changes in family or financial situations.

- Control: With a living trust, the grantor can maintain control over the grantor’s estate while alive, appointing themselves or another individual as the trustee to manage the assets according to their wishes. Upon their disability or death, they can state what how they would like their successor trustee to manage the trust account

- Disability Planning: A living trust can also provide for the management of the grantor’s assets in the event of their incapacity or disability.

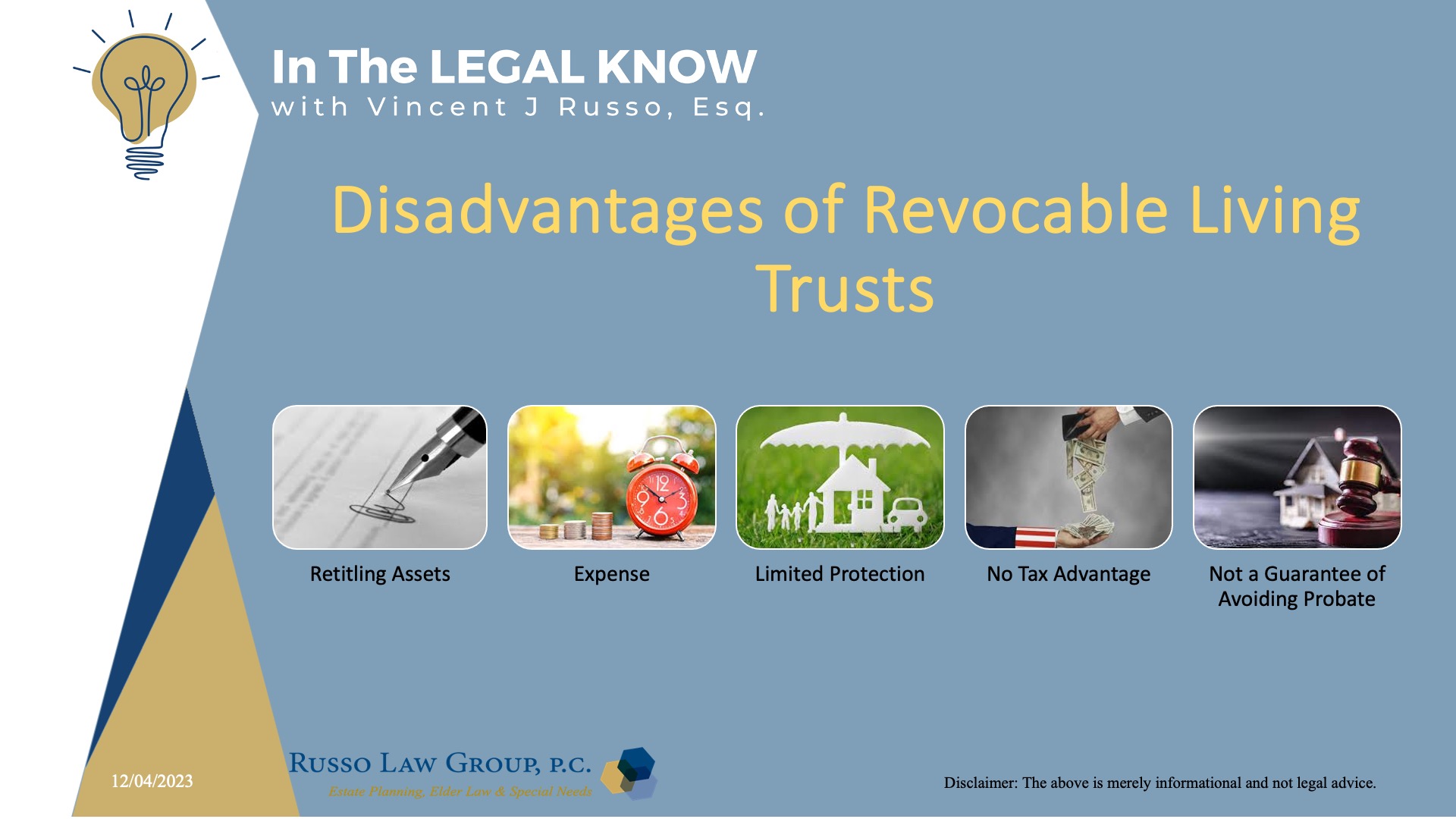

Are there any downsides to having a Revocable Living Trust?

There are some downsides to using a Revocable Living Trust in your estate plan:

- Retitle Assets: The primary disadvantage is that you must retitle your For example, if you want a trust to own your home, you’ll need a new deed naming the trust as the owner.

- Expense: The cost to set up and fund a living trust can initially be more expensive than creating a Will. However, the cost of administering a trust is usually much less expensive than the cost of going through the probate process with a Will.

- Not a guarantee of avoiding probate: Although a living trust can help avoid probate, it’s not a guarantee. Assets that are not properly transferred into the trust may still have to go through probate, which could defeat the purpose of creating the trust in the first place.

- Limited protection: A revocable living trust provides limited asset protection. Creditors can still go after the assets in the trust, and it is not effective in protecting assets from a lawsuit.

- No tax advantages: A revocable living trust does not provide any tax advantages over a will, and the grantor may still be subject to estate taxes upon their death.

Do you still need to have a Will if you have a Revocable Living Trust?

The answer is yes – this Will is commonly referred to as a Pour Over Will which states that if you have any assets in your own name without a beneficiary designation, then the Executor of the Will can collect those assets and transfer them to the Revocable Living Trust.

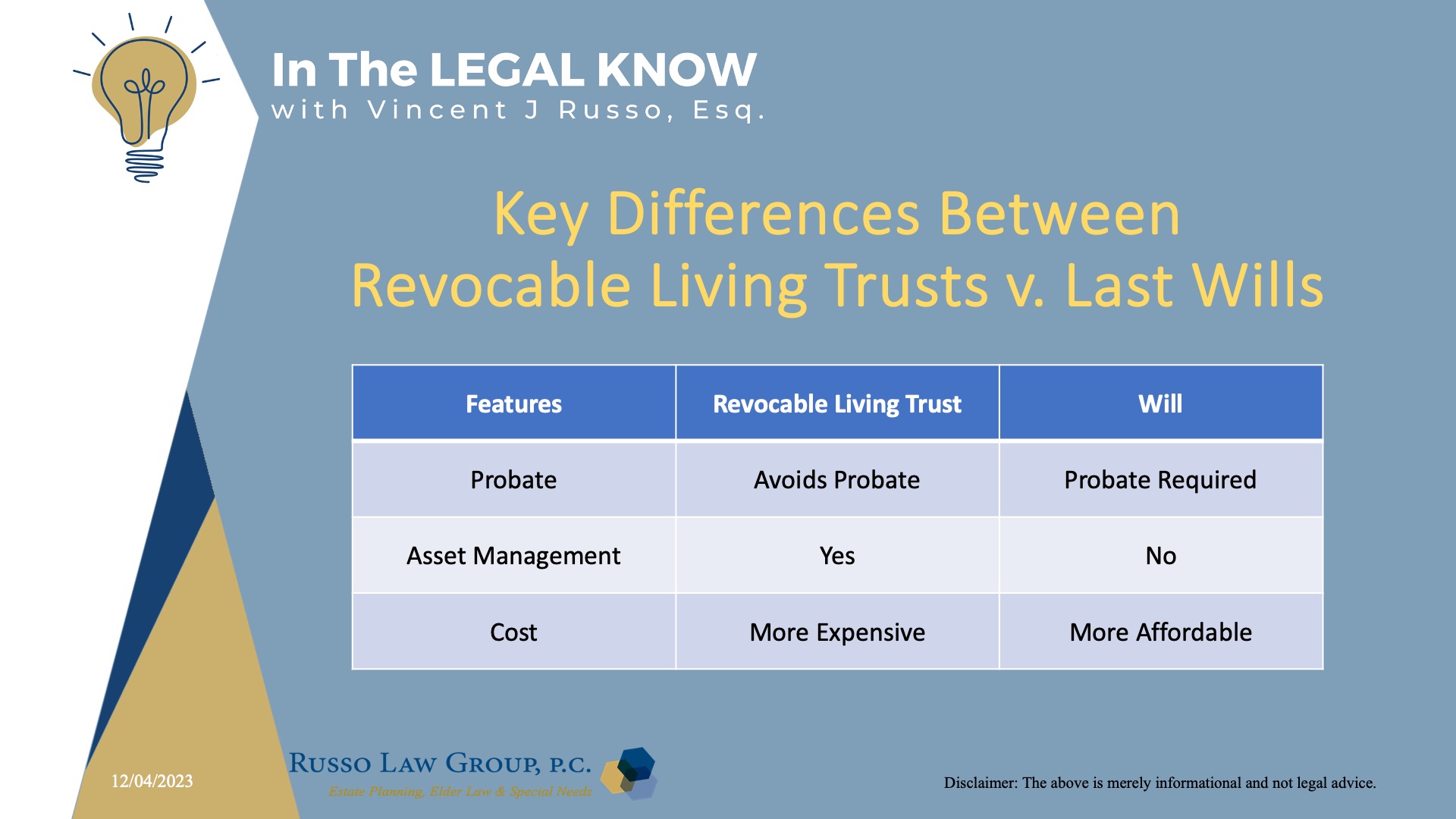

What is the main difference between a Revocable Living Trust and a Last Will and Testament?

There are three main differences between a Revocable Living Trust and a Will:

- Probate: One of the biggest differences between a revocable living trust and a will is how they handle probate. A will requires probate, which is the legal process of verifying the will, paying off any debts, and distributing the assets to the beneficiaries. Probate can be a lengthy and costly process, and it can also be a public process that exposes your assets and beneficiaries to public scrutiny. On the other hand, assets held in a revocable living trust can be distributed to the beneficiaries without going through probate, which can save time, money, and provide privacy for your estate.

- Asset Management: Another difference between a revocable living trust and a will is how they manage your assets during your lifetime. A will only takes effect after you die, whereas a revocable living trust can manage your assets during your lifetime if you become incapacitated or unable to manage them yourself. In this way, a revocable living trust can provide added protection and peace of mind for you and your loved ones.

- Cost: Finally, a revocable living trust can cost more to set up than a will. However, the cost may be worth it for those who want to avoid probate, ensure privacy, or manage their assets during their lifetime.

For more information, download our complimentary Estate Planning Guide HERE.

We hope you found this article helpful. Contact our office today at 1 (800) 680-1717 and schedule an appointment to discuss what makes sense for you and your loved ones.

Comments (0)